Environmental Pension Fund Crashes – The Future of “Renewable” Finance – No Golden Age of Sound Money – All Wars Are Not Bankers Wars! – Other Currencies in the Mix – Hyperinflation - [03-19-24]

Direct from BOOM Finance and Economics at the links below

Hat Tip to my colleague at BOOM Fin4ance and Economics Substack (Subscribe for Free) - also on LinkedIn and WordPress. Covid Medical News Network CMN News BOOM Blog and All Editorials (over 5 years) at BOOM Finance and Economics | Designed for Critical Thinkers — UPDATED WEEKLY (WordPress.com)

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers, and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn.

BOOM EDITORIAL THIS WEEK

PENSION FUND SPECIALISING IN ENVIRONMENTAL STOCK CRASHES. An Australian pension fund, the ‘Unisuper Global Environmental Opportunities Fund’, has crashed in value by one-third since June 2023. The fund is heavily invested in electric cars, renewable energy, and battery companies, with Tesla being its number one investment. 40% of the fund is invested in only ten stocks.

BOOM has exposed the downtrends in the shares of those companies which has been happening for over two years. Commercial viability seems to be the problem. And, if that is true, then these companies may never generate sufficient net profits to produce a dividend. If this hypothesis is proven true, private investors will inevitably sell out. In other words, the investor exodus may have just begun.

TESLA SHARES ARE UNDER THE MICROSCOPE. Tesla stock was under heavy observation by BOOM. Last week, the stock continued to fall. By the end of the week, it was down another 6.71%. It closed at $163.57, well below $170. It appears to be heading towards $100.

THE FUTURE OF “RENEWABLE” ENERGY FINANCE IS IN DOUBT. Commercial and economic viability is critical for any major change to energy supply. And the supply of energy has to be supported by the supply of fresh new money over time. The “true believers” have not considered this aspect enough.

As Vaclav Smil often says, “If you like to eat, stay warm in winter, and travel, you cannot do those things without hydrocarbon energy sources”. There is no effective alternative energy source available for fertiliser production, mass heating challenges in Northern Hemisphere winters, and transportation (especially aviation). Smil has written over 40 books about energy.

“SOUND MONEY” – THERE WAS NO GOLDEN AGE OF PEACE AND PROSPERITY WHEN MONEY WAS “SOUND”. COLONIALISM, CONQUEST, ROBBERY, AND SLAVERY WERE THE RESULTS. BOOM is constantly surprised by people who think that money should be “backed” by a rare or relatively rare commodity, such as a stash of gold, kept safely in a vault somewhere in a remote fortress and priced by either a very clever tyrant or a very clever committee of economists equipped with a crystal ball or a whole series of crystal balls. For many, this is an article of faith. However, let’s think about the consequences of the “sound money” policy. First, from a theoretical viewpoint, and then from an historical viewpoint.

THEORY, THEN HISTORY. Please note that in this simplistic, theoretical examination of the relationship between money creation, money volume, and prices of goods and services. BOOM is working at a tribal level and is avoiding:

The concept of asset price inflation or deflation and,

The concept of credit money creation (i.e. money created as bank loans by a commercial banking sector and recorded in bank ledgers of debits and credits). In other words, there is no private property and there are no banks.

In essence, a national currency is a social contract of general acceptance agreed by a nation’s people. A nation is defined in large part by this social contract because everyone uses the nation’s currency every day to settle transactions. It is actually “backed” by the shared trust arising from that mutual agreement of general acceptance.

The people assume (and ensure) that sufficient currency will be made available by their government and spent into circulation to allow them to purchase whatever goods and services are produced by that national economy. If the volume of currency in circulation is insufficient, the people will make that known to the King/Queen/Sovereign or Government/Council of Chiefs. A refusal to increase the volume of currency in such a circumstance will result in social unrest and the removal of the governing person or group.

The initial currency can be any physical element such as sea shells, salt, or beads. Some monetary theorists state that the cowrie is the most widely and longest-used currency in history. If too much money is created and the total volume of money rises over time while the production of goods and services is static, then the prices of available goods and services will rise in a CPI inflation.

If too little money is created over time and the total volume of money falls, while the production of goods and services is static, then the prices of available goods and services will fall in a CPI deflation.

NOW — LET’S “EVOLVE” AND “BACK” THE MONEY WITH GOLD OR SILVER. Metals are convenient, they can be used to create coins, and are physically resilient. In reality, because metal is used, it generates a natural, physical limit to the volume of new money issuance. The concept of “backing” a currency with a limited supply of a rare commodity such as gold stored in a vault adds another level of complexity.

However, limiting the creation of fresh new money in such a manner has economic consequences. The total volume of money in circulation must progressively shrink if the people save the precious gold-backed money and withhold it from use in the economy. A mismatch of money volume and the volume of goods and services being produced is inevitable.

If less money is progressively less available to purchase goods and services over time, then the prices of those goods and services will fall as suppliers become desperate to accept whatever currency is offered for their products. Money held in savings will rise in purchasing power. That is CPI deflation writ large. And, by the way, if the concept of private property arises, asset price deflation is also inevitable in such an economy.

If goods and services begin falling in price and volume and the total money supply is falling in volume, then the nation’s economy will stagnate and contract. Unemployment will inevitably result with its expected social tensions. Hoarding of the money will begin. We can call that “savings”.

In such a circumstance, some entrepreneurs or groups of entrepreneurs will eventually decide to employ the excess labour and weapons to build armies for adventures of conquest. Their aim will be robbery to seek/steal either:

More goods and services from conquered nations

More gold to expand the money supply or

More productive land and/or perhaps slave labour.

Stolen goods and services will enrich the conquering nation in that regard. Those goods and services will not have to be produced domestically. “Prosperity” will be the result.

Stolen gold will allow the expansion of the money supply. Thus, the domestic economy of the conquering nation will be able to expand. “Prosperity” will, again, be the result.

Stolen/imported slave labour or new land will lower the cost of production which will allow more goods and services to be produced.

THE CONCLUSION – REVEALED BY HISTORY. In economies that use “sound money” policies, military adventurism becomes inevitable. Warfare becomes the quickest and most certain way to expand the supply of goods and services, the store of gold (to expand the money supply), and the available labour force. It’s a Win-Win formula.

And history reveals that this was, indeed, a well-worn pathway to “prosperity” for many, many nations over many centuries. The Roman Empire and the Mongol Empire of Genghis Khan are two well-known and noteworthy examples but there are plenty of others. The Romans and Genghis Khan used metallic coins – “sound money” — made of gold, silver, bronze, or copper. There were some individual bankers in Rome, very decentralised, but there were no formally regulated, institutionalised, commercial banks as we know them today.

Three types of persons conducted banking activities in Rome: the argentarii, the mensarii, and the nummularii. They were private persons, free citizens, independent from the State.

There were argentarii of all kinds. Some were highly respected and from the upper class, usually, the ones carrying out business on a large scale and for very wealthy people, while some were looked down upon, the ones charging high rates and doing business on a small scale.

The mensarii (from the word mensa or ‘bank’ in Latin) were highly respected public bankers appointed by the state in special circumstances, usually in periods of general poverty, especially during periods of war; their goal was to help plebeians overcome economic difficulties and avert social unrest. The nummularii were officers of the mint and their main role was to test the quality of new coins.

Genghis Khan was the founder and first Khan of the Mongol Empire, which he ruled from 1206 until he died in 1227. It later became the largest contiguous empire in history. After spending most of his life uniting the Mongol tribes, he launched a series of military campaigns, conquering large parts of China and Central Asia. The Mongol army under Genghis Khan killed millions of people, but his conquests also facilitated increased commercial and cultural exchanges over an unprecedented geographical area.

The money of the Mongol Empire fell into two “sound” categories:

Coins for use in Muslim areas followed the well-established pattern of Islamic coinage: gold, silver, and copper denominations with Arabic inscriptions and geometric decoration.

Coins issued for East Asian parts of the empire look Chinese – mainly cast bronze with a square hole in the centre.

ALL WARS ARE NOT BANKERS WARS. The mantra “All Wars Are Bankers Wars” is often repeated without hesitation and careful thought. It is stated as dogma. But it just happens to be false.

[AP Observation: BOOM isn’t wrong by historical standards IMHO. The current mantra of “All Wars Are Bankers’ Wars” might hold to some degree only after the creation of the BIS in 1930. Before this time most wars were political but fuelled by the likes of the Rothschild Banking Fraternity et al.]

Countless wars have been fought for the creation of Empires long before modern banking became institutionalised in Venice only 400 years ago. Readers should take a look at the List of Empires available on Wikipedia; it is staggering. Most empires rose and fell long before Venice created formal, institutional, communal banks under the oversight of the Doge. https://en.wikipedia.org/wiki/List_of_empires

The History of Banking is worthy of consideration here to offer historical context. Here is a useful summary of banking in Venice which began with private, family-owned banks. However, regulated, institutionalised banking evolved and began with the first formal public bank in 1587, the Banco della Piazza di Rialto. It was named after the square beside the Rialto Bridge.

This followed earlier proposals, and the steady collapse during the 16th century, of the Republic’s private banks. A “run” on the private banks was all too familiar when people would run through the streets of Venice to remove their deposits before others could get there first.

“The private bankers’ book-transfer money was convenient but not stable in value. To address this problem, a public bank was proposed in the Senate as early as 1356 and again in 1374, but was not adopted. In the 16th century failures of Venetian private banks became a regular occurrence, amid several unsuccessful attempts at regulation, and the surviving banks’ deposits were valued below the same quantity in coins. The last bank, that of Pisano & Tiepolo, failed in 1584, whereupon an act to establish a public bank was passed and then immediately repealed. Three years passed without a bank, and then the Senate passed essentially the same act again.

This bank, the Banco della Piazza di Rialto, was a full-reserve bank guaranteed and inspected by the state that dealt only with deposits and transfers. Cheque service was added in 1593 with a law that required citizens to settle all bills of exchange at the Bank. Citizens indeed came to prefer transfers through the Bank to cash payments, although for very different reasons than those described in the legend.

The Banco del Giro (Bank of Circulation) was later established to serve a similar purpose, but also in the short run to finance a silver contract for the Venetian mint and several other public debts. The Banco di Rialto was wound down in 1637 and the Banco del Giro continued in business until the fall of the Venetian Republic in 1797.”

If this happened in 1587, where did the phrase “All wars are banker’s wars” come from? It is generally attributed to General Smedley Butler of the US Marine Corps. Butler wrote the book War Is a Racket, published in 1935. It is certainly worth reading some quotes from the book but Smedley was referring to the wars of the United States which he had been involved in, not the entire history of warfare; he says:

“I spent 33 years and four months in active military service and during that period I spent most of my time as a high-class muscle man for Big Business, for Wall Street, and the bankers. In short, I was a racketeer, a gangster for capitalism. I helped make Mexico and especially Tampico safe for American oil interests in 1914.

I helped make Haiti and Cuba a decent place for the National City Bank boys to collect revenues in. I helped in the raping of half a dozen Central American republics for the benefit of Wall Street. I helped purify Nicaragua for the International Banking House of Brown Brothers in 1902-1912.

I brought light to the Dominican Republic for the American sugar interests in 1916. I helped make Honduras right for the American fruit companies in 1903. In China in 1927 I helped see to it that Standard Oil went on its way unmolested. Looking back on it, I might have given Al Capone a few hints. The best he could do was to operate his racket in three districts. I operated on three continents.” [Smedley D. Butler, War is a Racket]

“WAR is a racket. It always has been. It is possibly the oldest, easily the most profitable, and surely the most vicious. It is the only one international in scope. It is the only one in which the profits are reckoned in dollars and the losses in lives.”

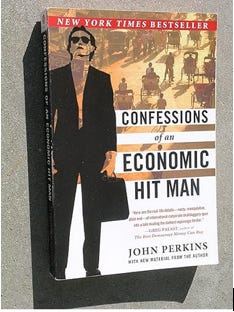

“I spent thirty-three years and four months in active military service as a member of this country’s most agile military force, the Marine Corps. I served in all commissioned ranks from Second Lieutenant to Major-General. And during that period, I spent most of my time being a high-class muscle man for Big Business, for Wall Street, and for the Bankers. In short, I was a racketeer, a gangster for capitalism.” [AP – reference: https://www.amazon.com/Confessions-Economic-Hit-John-Perkins/dp/0452287081]

Having read those excerpts, it is easy to see why the term, “all wars are bankers’ wars” originated and became a popular, dogmatic explanation in modern history. But it ignores the role of political tyrants, almost all of whom are psychopaths or sociopaths, hungry for power, ready and willing to use violence and warfare to enlarge and support their economies. The bankers act under the threat of violence in such situations.

At this juncture, BOOM encourages readers to research the history of ‘Vlad the Impaler’. Beware, Vlad was not a tame banker. [AP Comment – “tame banker”? There are many more ways to kill and injure other than direct, kinetic action and the bankers know how! A most powerful militarised weapon is starvation extant in Gaza, and Stalin killed many millions this way. Are these bankers’ economic weapons tame?]

OTHER CURRENCIES IN THE MIX - Currency dominance eventually evolves and for good reason. No nation should allow acceptance of any other currency in its domestic economy. As BOOM has explained in previous editorials, any politician who allows the circulation of any alternative currency inside their nation is committing the crime of High Treason. In other words, they are seeking to destroy the nation. Argentina is a perfect example. Argentinian politicians have tolerated the use of US Dollars inside their nation for many decades. We are now witnessing the inevitable outcome with severe CPI inflation and a government contemplating the end of the National currency in favour of the US Dollar.

CONCLUSION. In BOOM’s view, national currency volumes should never be restricted by the supply of a single, rare commodity, such as gold or silver. History teaches us that. It is akin to putting your money supply (and your economy) into a straight jacket.

Economic constriction will inevitably occur due to a collapse in new money volume creation while old credit money is disappearing due to bank loan repayments. Such a deliberate, restricted money supply will reduce economic growth, slow money velocity, and ultimately result in economic depression.

An endlessly contracting economy is not a pretty sight. And it is one from which the road back to growth and dynamism is long and tortuous. Such a money system (linked to a volume of a single, rare commodity) is deflationary in essence and especially so if the price of the commodity is incorrectly fixed. Finding a skilled committee of learned and wise economists to “fix” the price of gold (or silver) perfectly in the national currency is always an impossible task. Such economists do not exist in any volume.

If the price of the selected commodity is not fixed but allowed to float freely on a global market, then speculators will rush to dominate the ownership of it. By doing so, they will rush out of any cash holdings they have and then adopt derivative plays to capture any future supply of the commodity which, by its very nature, has a limited supply. Very few will be sellers of the commodity.

The obvious alternative is to fix the price of the commodity. Fixing the price is an extremely difficult task. In such a system, the price of a single commodity (limited in volume) has to be fixed by an all-seeing, all-knowing, all-intelligent committee of economists. Where do you find these “experts” with their crystal balls?

BOOM is not confident of finding even one, let alone a group of them. The alternative is to have a tyrannical dictator to set the price (or a tyrannical political party). Such a person is usually a psychopath or sociopath and is not naturally inclined to consider the welfare of the people under their control.

BOOM cannot find an example of an economy with a “sound” money system that has proved itself over the long term. Not only are they plagued by deflationary forces, economic contraction, and pricing problems, but they also inhibit entrepreneurship (except in warfare), economic complexity, equality of opportunity, and ultimately, prosperity. Thus, warfare and colonialism become the only way to achieve growth and wealth. Entrepreneurs quickly realise this and embark upon military expansion of the domestic economy. Robbery and slavery are inevitable in such a situation.

The history of the planet over many centuries bears witness to such dynamics. “Sound”, commodity-backed money does not result in economic or social nirvana. No jumbo jets. No welfare state. No vast infrastructure projects. No national healthcare systems. All of those things, which we all take for granted in the advanced economies today, simply cannot be funded by a restricted money supply. Money is like water for a garden. It is of no use to the garden if it is trapped in a dam. It must flow and be renewed.

MORE (RECENT) HISTORY - The British Empire abandoned the Gold Standard in 1931. Here is the Treasury Statement for the Press on Britain leaving the Gold Standard, dated 20th September 1931. Transcript PRESS NOTICE

“His Majesty’s Government has decided after consultation with the Bank of England that it has become necessary to suspend for the time being the operation of Subsection (2) of Section 1 of the Gold Standard Act of 1925 which requires the Bank to sell gold at a fixed price. A bill for this purpose will be introduced immediately and His Majesty’s Government intends to ask Parliament to pass it through all its stages on Monday, 21st September.

In the meantime, the Bank of England has been authorised to proceed accordingly in anticipation of the action of Parliament.

The reasons which have led to this decision are as follows. Since the middle of July funds amounting to more than £200 million have been withdrawn from the London market. The withdrawals have been met partly from gold and foreign currency held by the Bank of England, partly from the proceeds of a credit of £50 million which shortly matures secured by the Bank of England from New York and Paris, and partly from the proceeds of the French and American credits amounting to £50 million recently obtained by the Government. During the last few days, the withdrawals of foreign balances have accelerated so sharply that His Majesty’s Government has felt bound to take the decision mentioned above.

This decision will of course not affect the obligations of His Majesty’s Government or the Bank of England which are payable in foreign currencies. The gold holding of the Bank of England amounts to some £130 million and having regard to the contingencies which may have to be met it is inadvisable to allow this reserve to be further reduced.

During the last few days, the International financial markets have become demoralised and seem bent on liquidating their foreign assets in a spirit of panic. In the circumstances, there was no alternative but to protect the economy of this country by the only means at our disposal.

The ultimate resources of this country are enormous, and there is no doubt that the present exchange difficulties will prove only temporary.” Reference: https://www.nationalarchives.gov.uk/education/resources/thirties-britain/votes-peace/

Despite the last statement of intention, Britain never returned to the Gold Standard. The straight jacket had been removed. Forty years later, the Gold standard was effectively removed from the US Dollar in 1971 when Nixon abandoned it.

The next 10 years were fraught with rising CPI inflation as banks loaned credit money into existence rapidly, unshackled to any fixed gold stores. However, in 1981, the head of the US Federal Reserve (the central bank) raised the overnight target interest rate to 20%. Profligate bank lending was halted. That stopped the rising CPI in its tracks.

Massive complexity and prosperity have occurred in the last 50 years since the Gold standard was abandoned and since the events of 1981. Jumbo jets, airports, computers, massive infrastructure developments, and huge ships all combined to build our modern, advanced economies. For example, look at China which has a fiat money system and where they understand money supply growth very well indeed and perhaps better than any other nation. Their central bank is extremely well-run and thoughtful in managing the supply of money.

Show me any society in history that has achieved what they have for 1.5 Billion people since 1981. In BOOM’s opinion, their economists are the best on Earth but nobody acknowledges them. They use the principles of both communism and capitalism in managing their money system. They certainly don’t restrict the creation of their money supply to the production and storage of a single commodity.

Sound money is a cult with dogma and mantras. It cannot possibly support such rapid growth, complexity, and prosperity that we have today because, in a sound money system, the money supply is always restricted to the supply chain of a single, rare commodity.

The last 50 years have been a shining light in economic history, especially since 1981. No other era in history has been so liberating economically with China being the greatest example in history. But the USA, Japan, and Western Europe have also grown into complex, prosperous economies. And our life expectancy has been vastly improved over the last 50 years, especially for men. This is the triumph of fiat money.

As that famous American philosopher, Roseann, said “I’ve been rich and I’ve been poor. And rich is better”. [AP Comment: Presumably, he hasn’t read the life of St. Francis of Assisi!]

Many critics will point to examples of hyperinflation events in history and state “all fiat money systems eventually collapse”. But BOOM will counter that argument by stating that hyperinflation events can only exist when alternative currencies are tolerated and allowed to circulate inside a nation. That lesson has been (largely) learned and most modern, advanced economies will not allow other currencies to be used domestically.

BOOM is waiting for an example of a sound money nation where the perfect society existed, free of conquest, warfare, death, thievery, and slavery. Some may venture to Tibet or Bhutan as examples. However, if readers research the Wars of Tibet, the Tibetan Empire, or the History of Bhutan they will find that any peaceful existence in isolation is a myth.

References: Tibet and Bhutan

History of Tibet: https://en.wikipedia.org/wiki/History_of_Tibet

Wars of Tibet https://en.wikipedia.org/wiki/Category:Wars_involving_Tibet

[AP COMMENT – BOOM has offered a challenge and asks for a counter-example that I will be publishing on Saturday, March 30, 2024, so look out for it – “touché mon ami”]

Thanks for reading BOOM Finance and Economics. Subscribe to BOOM Finance and Economics on Substack linked below. BOOM has developed a loyal readership over five years (on other platforms) which includes many of the world’s most senior economists, central bankers, fund managers, and academics. Dr Gerry Brady 2024

BOOM’s QUANTITATIVE BOOSTING FOR THE PEOPLES MONEY EXPLAINED: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/ AND BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

COMING NEXT:

Letter from South Africa – CECIL RHODES - Saturday, March 23, 2024

BOOM Weekly Global Review – Tuesday, March 26, 2024

The Financial Jigsaw Part 2 – ‘All Wars Are Bankers’ Wars’ – Saturday, March 30, 2024 (with an added counter-argument]

In economics, things work until they don’t. Make your conclusions and do research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — this is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy. Watch the short 15-minute video and see Professor Richard Werner brilliantly explaining how global banking systems work.

In 2014, Richard Werner provided the first empirical evidence that banks create credit out of thin air. They do this whenever they issue a loan or, more specifically, purchase a promissory note. This is a walk-through of exactly how they do it.

Many economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources that are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Are you honestly trying to argue that all wars are not "banker's wars" - who is it that you serve P&S cause this argument rings hollow - present time and past to be honest.

So seriously - are you trying to "absolve" the bankers - and by the way - the debt they own - I'm debt free - it ain't my debt - is it yours?

So, seriously - I sure hope Boomy hasn't got you under a spell - cause the bankers are complicit today - and we may be peasants, but we ain't stupid and we know - for one living in South Africa - seems this would be self-evident.

A response would be appreciated, but either way I have ambitions, and I don't trust the bankers a whit - and if I can - I'll cast them off - I got no debt - they got nothing on me - the debt they own is theirs and theirs alone.