WHAT CAN THE WEST LEARN FROM CHINA? A Detailed Analysis - Commodities Prices in Review - [06-18-24]

Direct from BOOM Finance and Economics at the links below

BOOM EDITORIAL THIS WEEK

WHAT CAN WE LEARN FROM CHINA? Two weeks ago on Tuesday, June 2, BOOM presented an analysis of the economic outcomes in the two largest communist experiments in history – the USSR (the Union of Soviet Socialist Republics) versus the People’s Republic of China.

BOOM explained the dramatic differences in outcome as being attributed to three key variables – all of which were badly managed by the USSR, but well managed by the Peoples’ Republic of China.

The disciplined management of the banking/financial system

The role of productivity (or lack of it) in the respective real economies (where goods and services are produced and transacted). And …

The ownership of private property

Some readers have requested a further analysis. They want to know exactly how the Western advanced economies can possibly learn from China.

The Western ‘advanced’ nations are faced with demographic decline (ageing populations) which may result in progressive and falling demand for bank loans in the future, thus curtailing the money supply. Other problems arising are:

The threat of increased CPI inflation (or, perhaps more likely, increased deflation

Poor political leadership which is now based almost solely upon threat ideology, low economic growth, wealth disparity and brewing social unrest

The People are becoming restless, as evidenced by the shock results in the elections for the European Parliament last week

Economic growth is stalling in the EU

How can the West learn from the economic success of the Chinese system? And what can we learn from how the Chinese finance it all? Can we learn from China? Or should we ignore China’s success, unwilling to admit that we can learn from a totalitarian, ‘communist nation’? This begs the following question:

What did the Chinese leadership get right since 1949 compared to the failure of the USSR? BOOM offers the following for consideration and discussion on the strengths of the China Model:

A Strong banking sector control and regulation/strict control and management of money supply volumes

The allowance of large amounts of non interest bearing physical cash in circulation, ensuring high velocity of money

A capitalistic and well funded free market real economy (for the production and consumption of goods and services) but with close monitoring of domestic prices

Encouraging the private ownership of property rights

Preferential financing of the real, productive economy principally via bank loans and not via bond issuance. And discouraging the financing of asset speculation.

Examine the above more closely: BOOM has explained in a previous editorial that bankers in China earn low wages compared to other employees and especially compared to bankers in western nations. Being a banker is not regarded as a prestigious job in China.

Extract: “To illustrate how China’s financial system differs from the advanced Western nations, all we need to do is to look at the average annual salary of a Banker in China. That is approximately US$ 36,700 (266,000 Yuan/CNY). This is the average salary including housing, transport, and other benefits.”

Chinese bankers are functionaries they create, supply, and distribute fresh new money as bank loans on command from the central bank. The central bank, the PBOC (People’s Bank of China) determines the demand for money supply (both regionally and sectorally) and then commands the commercial banking sector to deliver the money targets.

This is very different from the western financial system where banking jobs are regarded as prestigious, highly paid, and where 97-8 % of the fresh new money supply depends upon bank loans generated at random borrower demand. If borrower demand declines, then all the central bank can (mostly) do is to reduce the interest rate/cost of credit.

Also, in the western financial system, a large amount of new money created as bank loans are too easily diverted into speculative ventures that are not ultimately productive to the real economy. Asset price inflation becomes the hottest game in town, not increased productivity, with increased production of goods and services.

Physical Cash was widely used in China until Alipay arrived in 2004. Since then, they have slowly but surely grabbed a huge share of the payments market via smart phones. All Alipay transactions below 200 yuan (US$28) are FREE of any fees or interest payments. This means that a vast array of everyday transactions are free of fees and interest charges, e.g. coffees, snacks, lunches, entertainment venues, bus and train tickets etc. Those transactions are, in effect, equivalent to physical cash transactions. This is a big reason why AliPay has been so successful and why the Chinese Central Bank Digital Currency, the E-Yuan, has been a failure.

In the BOOM editorial (Chinese CBDC Unpopular) July 30, 2023, BOOM explained: “As reported by Reuters, the central bank governor, Yi Gang, recently said that total transactions settled with the E-Yuan (e-CNY) amounted to just 1.8 Trillion Yuan since August last year. Expressed in US Dollars, this is equivalent to only US $ 257 Billion in just under 12 months. The Annual GDP of China is about $US 18,000 Billion. So, this is roughly equivalent to 1.4% of total GDP transactions.”

Alipay’s ‘Free of Fees’ and interest charge transactions effectively allow the electronic circulation of digital cash. This is constant water for the economic garden. The markets in the Chinese real economy are essentially free. This ensures entrepreneurial satisfaction but with the shared common knowledge that any excessive price increases will be monitored closely and punished.

A huge flow of command and directed fresh new money supply, created as bank loans, combined with massive non-interest bearing digital cash flows into the real economy create the circumstances whereby goods and services are transacted efficiently with high transaction velocity.

BOOM covered the private ownership of property rights in China in the BOOM editorial of two weeks ago. This encourages family stability and wealth creation. “In China, the Constitution was altered in 1970 to allow the private ownership of rights to property. That was strengthened in 1982 with the Property Law.”

China’s financial system in the real economy remains largely bank based and not bond based. Although China has become a main contributor to global trade, financial sector integration with the outside world has been limited. Except for bank lending to some Asian and African countries, the financial system is poorly integrated globally and remains relatively closed.

Domestically, the Chinese have used bank loans to finance their real economy companies much more than America which has a large and deep corporate bond market. At the end of 2023, Chinese Bank Loans in total value (expressed in US Dollars) amounted to around US$34tn. In the United States, the total was only around $US12tn. This is a staggering difference.

It illustrates the preponderance of bank loans (fresh new money) in the Chinese economy, as compared to bond issuance finance in the US economy. Bond issuance attracts old money as investment. No fresh new money is created when a Bond is issued to an investor.

In the United States, many companies funding use bond issuance in preference to bank loans. This is a critical difference as fresh new bonds do not create any fresh new money, they simply recirculate old money as investments.

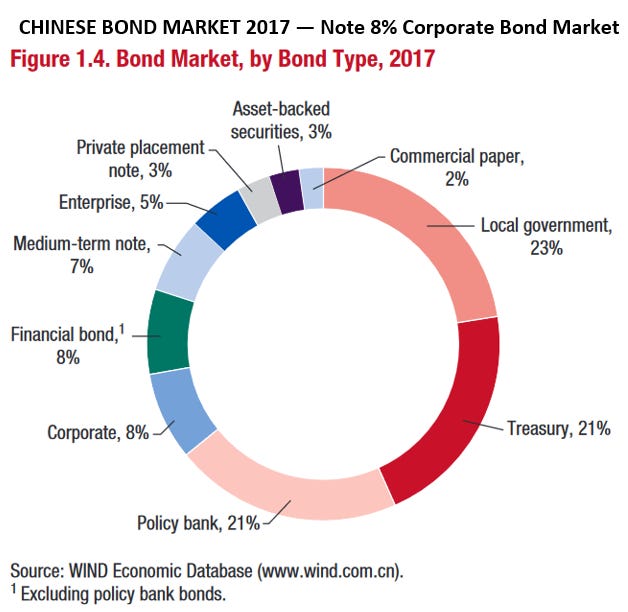

A report from S & P (Standard and Poors) in 2021 regarding the Chinese Bond Market stated, “Total bonds outstanding of US$17.4tn. Low correlation with global assets. The domestic Chinese bond market is only about 3% foreign owned.”

It was also reported that the Chinese banking sector’s share of credit to the non-financial private sector (the real economy) was 82% versus 33% in the US. This is a telling statistic.

The US Bond Market has bonds outstanding of US$53tn. If we exclude Treasury securities and Municipal securities, it is about $17tn. Corporate Bonds outstanding are approximately US$10.35tn of that total. This is the key metric to take note of; China’s corporate bond market has increased significantly over the last few years but is currently only $ 6.3 trillion.

These observations are important. The Chinese Corporate Bond market is significantly smaller than the US market. Chinese companies, historically focused on productivity and the generation of goods and services, have principally borrowed from banks. They have not tended to issue bonds.

Note: Chinese Corporate Bond issuance has only been allowed since 2007. The total Chinese Corporate Bond issuance in 2017 after 10 years was only 8% of the total Chinese Bond Market. This has increased since 2017 with the total Chinese Corporate Bond Market now around US$6.3tn.

By comparison, America’s Total Corporate Bond market is currently around $10.35tn. Note also that Chinese corporate bond volume has fallen over the last two years. Nothing happens in China without the PBOC (People’s Bank of China – the central bank) noticing or perhaps being causative. BOOM suspects that the PBOC has deliberately discouraged the growth of corporate bond issuance.

COMMODITY PRICES IN REVIEW - Over Last Three Years (all prices in $US) Because CPI inflation is so topical, BOOM has reviewed US dollar price dynamics for global commodities over the last three years. There is a strong inherent bias towards US market prices and US commodity markets. The United States is used as a proxy for all advanced economies.

Bear in mind that different national economies have differing balances between their goods-based economies (sensitive to commodity prices) and their services-based economies (which are not sensitive to commodity prices).

The gold price has been in a strong uptrend since late 2022, especially over the last six months. However, it has stalled a little over the last three months with some technical signs of weakness. There may be a market top in formation or it may be a consolidation period before further price rises resume.

Watch closely for a fall below US$2,300. That may indicate a bigger pull back than expected by many market participants. Gold has little use in the real economy. It is not used much in the creation of goods and services, with the exception of jewellery manufacture and some use in electronics. It is thus primarily a commodity used purely for speculation.

SILVER — Silver prices have been in a similar Uptrend since late 2022 but more especially since early 2024. It also appears to be pulling back over the last month.

PLATINUM — Platinum has not followed Gold and SIlver. Over the last 3 years, it has been effectively trapped in a trading range.

PALLADIUM - The Price has shown no sign of uptrend for the entire period under review. A false dawn occurred in early 2022. Palladium has many industrial uses. Is it time to buy Palladium and sell Gold and Silver as the global economy recovers from the shock of the Covid PanicDemic?

COPPER - The chart looks ominously similar to those of Gold and Silver. Is this the end of the Bull Run? Has Copper become both an industrial metal and a speculative commodity? The chart suggests that this is the case. If so, it seems to be leading Gold and Silver lower.

ZINC — Zinc has been most often falling over the three year period. Is a change of trend coming as a sign of global economic growth?

TIN has been falling over the three year period. During 2024, it has changed trend. Manufacturers use tin in applications ranging from soldering, plating, to alloys. As a result, tin is a key industrial metal in global markets. Its recent uptrend suggests increased demand.

NICKEL — Nickel has been falling over the three year period. Is a change of trend forming? Nickel is used in many recognisable industrial and consumer products, including stainless steel, alnico magnets, coinage, rechargeable batteries (e.g. nickel–iron), electric guitar strings, microphone capsules, plating on plumbing fixtures, and special alloys such as permalloy, elinvar, and invar.

COBALT - price decline is dramatic. It suggests a dramatic decline in demand or increase in supply. Or perhaps both in unison? Is the dramatic price decline telling us something big about the future of electric cars?

WEST TEXAS LIGHT CRUDE — prices have been falling since early 2022. Where is the CPI inflation threat?

NATURAL GAS — Is this indicative of abundant supply? Or falling demand? Where is the CPI inflation threat?

GASOLINE — Follows the general energy trend. Is this indicative of abundant supply? Or falling demand? Where is the CPI inflation threat?

SUGAR — falling prices indicating drastic weather related events? Where is the CPI inflation threat?

CORN — Corn farmers are under attack too, it seems. Dramatic falls in price since early 2022. Again, where is the CPI inflation threat?

ORANGE JUICE — So — is this where all the CPI inflation threat is arising? In orange juice? Grow oranges, young man! Or, sell the farm now?

LIVE CATTLE — So, Klaus Schwab got it all wrong? We won’t be eating Ze Bugs? Demand seems to be strong for meat. Or is it lack of supply as farmers switch to growing Ze Bugs? BOOM does not think so. Has Klaus been retired off to a prison cell somewhere for committing the sin of failure?

URANIUM — The speculative bubble that began in mid 2021 at US$30 per lb may have finally burst. Is it leading Copper, Gold, Silver and Bitcoin down to lower prices? [AP Comment: “About 60 nuclear reactors are under construction across the world. A further 110 are planned. Most reactors under construction or planned are in Asia. New plants coming online in recent years have largely been balanced by old plants being retired.

BITCOIN — The Digital Commodity — looks like a top may be forming? Or just consolidation? Very similar to Gold, Silver and Uranium over the last three months. Is the speculative frenzy over in these four “precious” speculative commodities?

BOOM’s QUANTITATIVE BOOSTING FOR THE PEOPLES MONEY EXPLAINED: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/ AND BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

COMING NEXT:

The Financial Jigsaw, Part 2 – THE GLOBAL CHESSBOARD – Saturday, June 22, 2024

BOOM Global Weekly Review – Tuesday, June 25, 2024

In economics, things work until they don’t. Make your conclusions and do research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — this is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy. Watch the short 15-minute video and see Professor Richard Werner brilliantly explaining how global banking systems work.

In 2014, Richard Werner provided the first empirical evidence that banks create credit out of thin air. They do this whenever they issue a loan or, more specifically, purchase a promissory note. This is a walk-through of exactly how they do it.

Many economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that website or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities or investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources that are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. By Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

In some place central banking control might be consistent with the historical ideology of the folks living in said places - so if that is the case - then let t he central banks have power over the movement of products and creation of goods. Fine if that is what they desire there and it is consistent with the ideology of folks living there.

In other places, take the us of a for instance - there has been a long-time conflict with the ideology of bankers who think they get to call the shots and run the show. Consider Hamilton - the first banker lover in the new country of the us of a, but consider Jefferson and Madison as well and then later on Jackson who told the bankers to shove it up their a-holes.

So what is good for those in China is good for them, but what is good for them, may not be good for everyone and historically in the us of a - there has been conflict twixt the bankers trying to run the show versus the founders who had ideas otherwise - Hamilton excluded in that regard.

To each their own I reckon - but frankly, if some folks want to be under central control by choice - then god bless em I reckon - but the country I reside within was founded upon the concept of "lack of central control" - makes one wonder - when did everything go wrong in that regard?

Isn't the collateral for any loan considered an asset, or am I missing something here?

How is China going to organize the BRICS when they all have such dissimilar banking methods?