Interest Rate Cuts – Physical Cash Essential in Global Computer Crash – The Benefits of Physical Cash Money versus Credit Money – Tesla in Focus Again - [07-30-24]

Direct from BOOM Finance and Economics at the links below

Hat Tip to my colleague at BOOM Fin4ance and Economics Substack (Subscribe for Free) - also on LinkedIn and WordPress. Covid Medical News Network CMN News BOOM Blog and All Editorials (over 5 years) at BOOM Finance and Economics | Designed for Critical Thinkers — UPDATED WEEKLY (WordPress.com)

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers, and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn.

BOOM EDITORIAL THIS WEEK

INTEREST RATE CUTS ARE HERE ALREADY. Last Sunday, BOOM’s lead article was headlined “Interest Rate Cuts are Coming”. Last Wednesday, the central Bank of Canada cut its key interest rate by 25 basis points for the second month in a row, bringing it to 4.5%. They also announced that more cuts were likely if CPI inflation continues to reduce throughout the rest of 2024. They have kept the policy rate at a two-decade high of 5% for almost a year in a bid to combat high inflation.

In China, the Peoples Bank of China cut the 7-day reverse repo rate on Monday by 20 basis points. Then the PBOC announced a 20 basis point cut to the 1-year medium-term lending facility (MLF) rate, bringing the MLF down from 2.5% to 2.3%. These lower rates were all a surprise move to the markets. China’s annual inflation rate edged down to 0.2% in June 2024 from 0.3% in the prior two months. It was the lowest figure since March amid a fragile economic recovery.

None of these moves were a surprise to BOOM. In the UK, the vast majority of economists expect the Bank of England to cut its key rate next week. It is currently at a 15-year high of 5.25%. To reach that level, there have been 14 consecutive rate increases:

The CPI inflation rate in the UK has reduced to 2 %. Food Inflation has dropped dramatically, from above 14% in July 2023 to less than 2 %, but services inflation remains sticky.

BOOM will be stunned if the Bank of England does not cut rates at its next meeting and is expecting a 0.5 % cut. BOOM also expects the Reserve Bank of Australia to either keep rates on hold at its next meeting or perhaps make a surprise 0.25 % cut.

In the current circumstances, it would be foolish in the extreme for the RBA to raise rates while the rest of the Western advanced economies are decisively moving towards lower rate settings. Long term BOOM readers will remember that BOOM called the top of CPI inflation in the Western advanced economies way back in mid October 2022.

GLOBAL COMPUTER CRASH PROVES PHYSICAL CASH IS ESSENTIAL IN ANY ECONOMY. The global computer crash last week proved the value and utility of physical cash. Long term readers will know that BOOM is a strong supporter of physical cash. It has many economic and social benefits, often overlooked.

Politicians and their advisers seem blind to the importance of cash as a buffer to excessive credit creation. Last week’s botched software update by Crowdstrike showed us just how fragile our electronic world has become. One single point of failure almost brought world economies to a standstill. Crowdstrike shares were hammered — down by 16% over the week with more to come next week, presumably.

CrowdStrike said that 8.5 million devices were affected from it’s botched software update. The outage led to over 1,500 cancelled flights in the US and many thousands more around the Globe. Many passengers were left stranded in airports. Hospitals, GPs, pharmacies, banks, supermarkets and millions of businesses were also affected. CrowdStrike said the outage was caused by a defect in an update to its “Falcon” cybersecurity defence software for Windows hosts.

People with no physical cash were left stranded by the defunct payment system, unable to buy food or drinks. That is a disturbing experience and one which BOOM never wants to see again. Politicians must take note and make sure that this never happens again. Everyone should be encouraged to use physical cash and merchants must be encouraged to always accept it.

This was a big lesson that the so-called “cashless economy” is a very flawed concept. Merchants MUST ensure that cash is always an option. This crisis lasted only a short time but the system is clearly weak, fragile and susceptible to failure. Next time (if there is such a thing), IT systems could become non-operational for days – or (gasp) weeks in a worse case situation.

BOOM reported this on August 15, 2023, “In the West, there is a decline in the population of willing borrowers due to their declining working age populations. To ensure a return to economic growth and controlled CPI inflation, Western governments will have to quickly issue increased volumes of non-interest bearing, physical cash into their economies and encourage people to use it as much as possible. In other words, Western governments will have to take back the control of their money supply which they have effectively surrendered to private (retail and commercial) bankers over the last 400 years and especially over the last 50 years.”

Bankers create fresh new credit money when they issue loans to willing borrowers.

BOOM went on to explain that under our current debt-based Western money system: “if borrowers become either reluctant or shrink in number from disease, demographics or warfare and the Government does not increase physical cash in circulation, then the economy becomes starved of fresh newly originated money. The result is economic stagnation.”

Of course, there is a third option available if the money supply weakens sharply and that is Quantitative Easing (QE) where fresh new money is created in the banking system without external borrowers and spent into the real economy via asset purchases. Central banks are reluctant to use QE because it can distort asset markets, leading to asset price inflation or it can trigger higher rates of CPI inflation. They are particularly reluctant to use large volumes of QE because of those potential adverse consequences.

The best option is to permanently increase the volume, velocity and availability of physical cash. The real economy should be incentivised to use physical cash at all times and adequate quantities must be made available with easy access.

Only a foolish nation abandons its currency, either in a currency union (such as the Euro) or in the form of physical cash. Any central bank that cannot see this is also foolish in the extreme. And any government that cannot see this is worse than foolish. It is arguably acting in treason against its own people.

This can be summed up easily as a matter of economic principle – Physical Cash must always be readily available in any economy and its use encouraged. No foreign currency must be allowed to circulate.

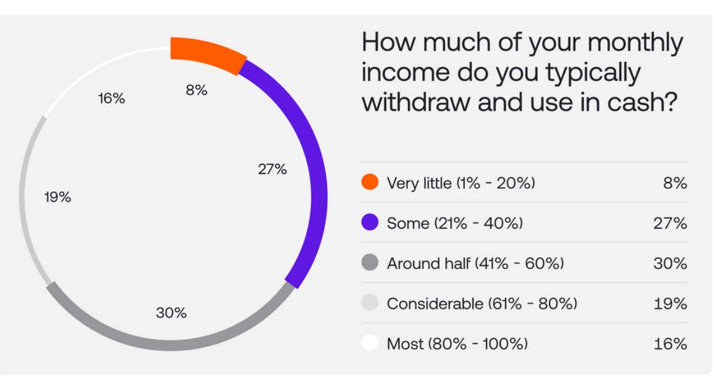

CASH IN SOUTH AFRICA. Cash is especially popular in South Africa. A recent survey there showed that roughly 65% of South Africans withdraw over 40% of their monthly income as cash. Only 8% said they withdrew less than 20% of their income.

Despite being a highly banked population, a recent report by payments provider Stitch found that many South Africans still withdrew a significant portion of their salaries to transact in cash. “As many as 95% now have a salary paid into a bank account each month, but many of them withdraw all or most of its as cash for day-to-day transactions,” Stitch found.

“Even as digital payment methods have grown in popularity in recent years, cash remains dominant. Our research found that South Africans use cash regularly, typically on a weekly or even daily basis.”

BOOM doubts if you will ever see bankers discussing the benefits of physical cash. But there are many. Let’s look at the list of benefits of cash. BENEFITS OF PHYSICAL CASH MONEY:

Cash is Sovereign money,

Cash is the Peoples money,

Cash is non-interest bearing at origination,

Cash is fungible,

Cash is non-electronic,

Cash is anonymous,

Cash supply is immediately responsive to increased demand from the people,

Cash provides an excellent buffer against excess creation of interest bearing credit money. By comparison, Credit money is created as a bank loan, is kept on an electronic banking ledger and therefore is mostly collateralised against existing assets which re-enforces the Cantillion Effect.

The Cantillion Effect was described way back in 1755 by Richard Cantillion in Ireland (it was published long after his death, by the way). His observation on money supply is historic and one of great clarity. He described how some members of society benefit more from being closest to the origination of fresh new money.

In other words, if most fresh new money is created as a bank loan, then that will favour the rich and powerful (who own assets that can be used as collateral) over the poor and the weak. It will, of course, allow those people to purchase yet more assets and thus this effect gives rise to asset price inflation which is a subject almost never mentioned by economists, bankers or politicians.

GOVERNMENT DEBT TO GDP RATIOS AND EXCESSIVE RISK TAKING. BOOM never recommends other economic commentators. Why? Because BOOM is unable to find anyone, anywhere, who is worth the time reading. Most belong to obscure economic religions and simply regurgitate the dogma of whatever “school” of economics they adhere to.

Sadly, economics is largely an intellectual wasteland, devoid of curiosity. The subject of government debt is a typical example. There are seemingly endless numbers of articles on the matter and the authors almost always refer to the ratio of Government debt to GDP as if it is a proven indicator of economic doom. And yet, this ratio never seems to bear any predictive success.

BOOM knows why. The ratio compares 20-30 years of government bond issuance (“debt”) to just one year of GDP. It is a ridiculous comparison. The debt will mature at many different maturity dates over many different years in the future. The annual GDP is an assessment of past total transactions that have occurred in the previous year. BOOM cannot understand why the ratio exists. And the numerous articles written about it are of little to no value. So why are they written?

The issue of excessive Private Debt is far more consequential to any economy. However, it is avoided like the plague by economic commentators. BOOM cannot understand why this is ignored but suspects that the banking system has undue influence on the “profession”, either via surreptitious control of the education of economists, or via power over their employment prospects.

EXCESSIVE AMOUNTS OF PRIVATE DEBT DISTORT ASSET PRICES (causing asset price inflation). Such excess cannot exist without irresponsible bankers making poor decisions regarding bank loans. If bankers extend too much debt-money to borrowers who are overly optimistic, the money supply blows out.

And that debt is usually based upon excessive valuations of assets (most often of real estate). All of this is symptomatic of unwise and excessive risk taking both by bankers and borrowers. Those excessive valuations have a knock on effect in the CPI inflation pressures inside the real economy. The result is a roller coaster ride of difficulty in controlling the subsequent CPI inflation.

The central bank then says “gee whiz, how did that happen” and they pull on their only lever of control, interest rate settings. Money volume management is simply largely ignored. And the central banks have no direct money volume control mechanisms, preferring to have a blind faith in their “monetary policy”.

Again, BOOM suspects that this is all left unattended because the roller coaster ride benefits the profit potential of the retail and commercial banks. Banking should be much more akin to a public utility and it is the politicians who need to understand it. If the banking system is dominated by shareholder owned banks, focused on “shareholder value” and dividends, then the roller coaster is inevitable.

The solution is to have a mixed ownership model for the banking system. Community owned, mutual banks which do not issue dividends are extremely important. And government owned banks need to be operated that return profits to the taxpayers.

Also, the importance of physical cash must be understood. Lastly, there must be significant incentives extended to entrepreneurs who seek to build private businesses and family wealth. Western advanced economies now do the exact opposite with public servants earning ridiculous salaries for taking no personal financial risk whatsoever. If these matters are well understood by the political class, economic stability will be the result.

TESLA UNDER SHARP FOCUS AGAIN. Tesla announced disappointing profit figures last week. The shares, which had been rising sharply in a short squeeze from late-June to mid-July, were immediately hit with determined selling. In after hours trading, the price was knocked down by over 12% for the day. It ended the week down 8.11%, closing at $219.80

TSLA’s long term downtrend will be significantly strengthened by such a fall but not fully confirmed until below $160. In BOOM’s opinion, a realistic valuation for Tesla on latest data is (probably) circa $100 or below.

Tesla’s second-quarter net income fell 45% compared with a year ago as the company’s global electric vehicle sales fell despite price cuts and low-interest financing. It made $1.48bn from April through June, less than the $2.7bn it made in the same period in 2023. It was Tesla’s second quarterly net income decline. Second quarter revenue rose 2% to $25.5bn.

Over half of Tesla’s profit came from selling government sponsored regulatory credits to other car companies. That government money is pure profit. There are no operating costs attached to it. It totalled almost $1bn in this quarter’s results. Because Tesla is an electric car specialist, it receives these credits for free and can sell them to other car companies.

Tesla’s market valuation would be considerably less if these were removed by a new government. Tesla earned almost $1.8bn from the credits during 2023 according to their Annual Report and $9bn in total since 2009. Readers can check at a recent Securities and Exchange Commission filing

COMING NEXT:

The Financial Jigsaw, Part 2 – BIG GOVERNMENT IS THE ENEMY – Saturday, August 03, 2024 (Extended edition with paywall lifted this)

BOOM Global Financial Review, Tuesday August 6, 2024

In economics, things work until they don’t. Make your conclusions and do research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — this is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy. Watch the short 15-minute video and see Professor Richard Werner brilliantly explaining how global banking systems work.

In 2014, Richard Werner provided the first empirical evidence that banks create credit out of thin air. They do this whenever they issue a loan or, more specifically, purchase a promissory note. This is a walk-through of exactly how they do it.

Many economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that website or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities or investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources that are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. By Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.