HOUSING CRISIS - Gilts - Little Boxes - Living Costs - Builders AWOL - Solar Dies - Big Plans - Net Zero - A Saga - Gen Z; No War - Inflation - JIT - Crypto - Letter from Great Britain – [01-25-25]

Nothing is new under the sun: "Many of the Israelites began dwelling in the houses of the dispossessed Canaanites" [Deuteronomy 6:10]

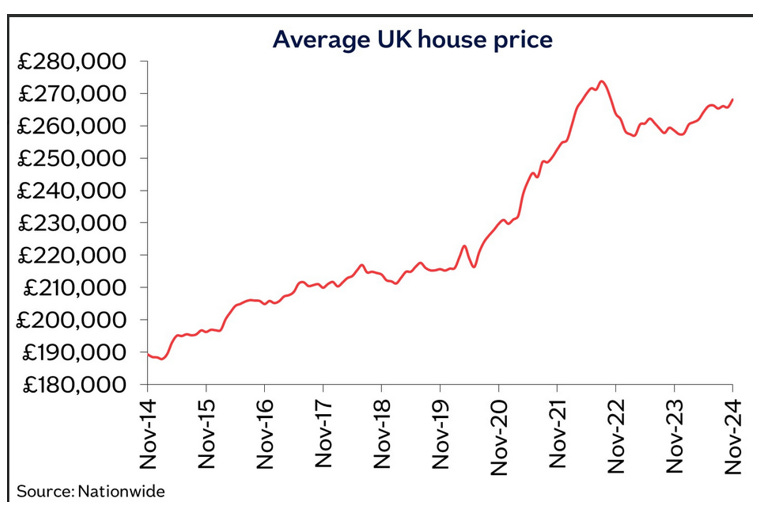

BRITAIN'S HOUSE PRICES RISE. What's your favourite house price index? No doubt many are team Nationwide but Halifax is good too. The various housing market measures tend to move up and down together. Source: HM Land Registry

The sudden price rise was a surprise when Nationwide and Halifax published their figures for November recently, recording month-on-month (MoM) price rises at 1.2% and 1.3%, respectively. Halifax has reported higher prices for five consecutive months, while Nationwide claims November saw the biggest monthly hike since March 2022.

In annual terms, both lenders witnessed the fastest growth for two years, with property prices up 3.7% (Nationwide) or 4.8% (Halifax). In nominal terms, house prices are now just 1% below the highs recorded in the summer of 2022. Though in real terms, prices are around 10% below their peak, depending on your preferred measure of inflation.

Experts were confounded by the strength of the market, with consensus forecasts for just 0.2% MoM growth and a modest 2.4% annual increase. "The acceleration in house price growth is surprising, since affordability remains stretched by historic standards, with house prices still high relative to average incomes and interest rates well above pre-Covid levels." commented Robert Gardner, Nationwide's Chief Economist

Some have speculated that buyers brought forward purchases to beat the changes in stamp duty announced in the Autumn Budget. However, Nationwide points out that it's unlikely to be a significant factor as "the majority of mortgage applications commenced before the Budget".

That said, the lender does expect a short-term impact in the coming months. "[The change to stamp duty] is likely to lead to a jump in transactions in the first three months of 2025 (especially in March) and a corresponding period of weakness in the following three to six months, as occurred in the wake of previous stamp duty changes." said Robert Gardner, Nationwide's Chief Economist

Homebuyers seem to have shrugged off higher interest rates, with the number of mortgage approvals now back to pre-pandemic levels. Expect the housing market to hold up as long as unemployment remains contained and wages continue to rise in real terms. It helps that household balance sheets are relativitly stronger in the aggregate. Britons have steadily deleveraged since the financial crisis, with household debt down from 156% in 2008 to 121% this year.

While a property market crash is improbable at this stage of the cycle as restricted affordability limits how fast prices could rise in future. There are many ways to measure the affordability of homes. One telling statistic is how much of the pay-packet the typical first-time buyer needs to spend serving their mortgage. By this measure, houses are significantly more expensive than their long-run average.

Price rises are far from uniform across the country. Halifax saw the fastest growth in Northern Ireland (+6.8% YoY), while the North West (+5.9%) experienced the biggest increase of any English region. Prices are growing much more slowly in London (+3.5%) and Scotland (+2.8%). Actually, London's housing market is in the midst of a protracted slump. As Neal Hudson pointed out in the FT:

"In the past decade, London house prices have increased by just 13%, that amounts to a 16% fall in real terms. The city's average house price would buy 2.4 homes in the North West. Back in 2016, it would have bought you 3.4 homes." wrote Neal Hudson . Higher interest rates have affected London more than other regions, as larger mortgages and higher loan-to-value ratios are needed to buy the capital's expensive homes.

A great deal hinges on the speed and scale of interest rate cuts. The Bank of England governor, Andrew Bailey expects four interest rate cuts next year. But the budget's potential upward impact on inflation means the path of monetary policy is far from certain. Bailey added, “We’ve been looking at a number of potential paths ahead and some of them are better than others.” [Ed: statement of the bleeding obvious!] Sources

· Cost of buying average home in England is now unaffordable, warns ONS (The Guardian)

· Nearly two-thirds of working private renters in England struggle to pay rent struggle to pay rent (The Guardian)

A DIZZYING RISE IN BOND YIELDS

AND GBP HAS SUFFERRED ACCORDINGLY:

Two things happened this month signalled revisiting those tumultuous 'Liz Truss' six weeks in 2022. Truss sent a cease and desist letter to Keir Starmer, accusing the Prime Minister of causing "serious harm to her reputation" by claiming she "crashed the economy". Truss argued that "crashing the economy" is conventionally understood to mean falling GDP and rising unemployment, neither of which happened in her 45 days in office.

It is more accurate to say she crashed the gilt market, crashed defined-benefit pension funds, and crashed her own premiership in record time. 'Your honour, I did not crash the car, I merely crumpled the bonnet, knocked off the wing mirrors, and cracked the windshield.'

Anyway, time will tell how well she fares in her legal battle against the former Director of Public Prosecutions. The more important reason Truss is in the headlines is because Britain's borrowing costs are rising sharply once again, prompting unflattering comparisons to her brief time in office.

Is this the Liz Truss fiscal fiasco all over again? Gilt yields are indeed rising, with the 10-year yield hitting a post-2008 high of 4.81% and 30-year bonds paying more than 5.4%, the highest since 1998 - Source: Trading Economics

However, despite long-term borrowing costs reaching an almost three-decade high, the situation is nowhere near as extreme as the Truss mini-budget. Britain is not an outlier this time. Developed market governments have all been paying higher borrowing costs in recent months, particularly on long-term debt. Tracking the relative change in British yields since the Autumn Budget, versus its peers, bears no resemblance to the extreme and isolated spike in gilt yields following the Truss mini-budget. The US 30-year Treasury yield was around 3.5% during the Truss episode; today, it's 4.9%, thus gilts are broadly keeping pace with Treasuries rather than blazing their own path.

Why are global yields pushing higher? In the US, bond investors worry that Trump's tariffs could reignite inflation, and tax cuts may further balloon the fiscal deficit. Furthermore, traders anticipate a change in the structure of Treasury issuance. the new Treasury Secretary, Scott Bessent favours issuing more long-term debt rather than the short-term borrowing favoured by Janet Yellen's Treasury Department.

BUT it's not only governments that borrow in the bond markets. In recent weeks, companies have accelerated issuance to record levels, seemingly taking advantage of calm markets and tight credit spreads before Trump took office. To some extent, Treasuries and corporate bonds compete for the same buyers, so yields tend to rise when there's more debt for sale.

Sterling slid versus the dollar and other currencies since the Autumn Budget to trade at a 14-month low. This is unusual when gilt yields are rising as ordinarily, higher bond yields tend to attract capital inflows and boost the currency. When both fall together, it can be a sign of concern over the government's fiscal stability and ability to service its debts.

An extreme version of this phenomenon happened in the 1970s when Britain was forced to seek an IMF bailout. Former Bank of England policymaker, Martin Weale has warned of similarities. today. It's clear that Britain faces economic challenges and inflation remains sticky, particularly in the service sector, with wage growth remaining unsustainably high.

Growth has been relatively stagnant for more than 25 years, with GDP shrinking by -0.1% in October and employers warning that a hike in National Insurance and the minimum wage will depress hiring and investment. Meanwhile, the government's plans to ramp up debt issuance to fund public services and infrastructure might cause commotions in the bond markets, especially now that Trump is the new boss.

Britain's assets are also having a tough time, with the domestically-focussed FTSE 250 remaining 10% below its pre-covid levels. Consumer confidence is weak, and mortgage borrowers will be concerned about rising rates. 700,000 British households must refinance fixed-rate mortgages this year, and mortgage costs will track higher gilt yields. Today's average 2-year fixed residential mortgage rate is 5.47%, and sterling interest rate swaps, which drive mortgage pricing, have risen by 50 basis points since September.

The most significant impact of rising gilt yields is on government finances. At the time of the Autumn Budget, the chancellor had fiscal headroom of £9.9bn. That's not a lot of margin for error in the context of £1.33tn in annual government spending!

Capital Economics reckons that the recent move in bond markets has more or less wiped out the headroom, with around £9bn added to Britain's borrowing costs. The Office for Budget Responsibility (OBR) is due to issue a fresh forecast in March, at which point the government may be forced to rethink its fiscal plans.

Should the sums no longer balance, the chancellor only has three possible solutions: raise taxes, cut spending, or break her self-imposed fiscal rules. The Treasury hinted that it would favour the second option, and wants everyone to know that under no circumstances will the fiscal rules be binned. "No one should be under any doubt that meeting the fiscal rules is non-negotiable and the Government will have an iron grip on the public finances. UK debt is the second lowest in the G7, and only the OBR's forecast can accurately predict how much headroom the government has, anything else is pure speculation."

"Kick-starting economic growth is the number one mission of this Government as we deliver on our Plan for Change. Over the coming weeks and months, the Chancellor will leave no stone unturned in her determination to deliver economic growth and fight for working people." said HM Treasury Spokesperson [Ed: good luck with that - 25+ years of GDP stagnation will need a miracle to change the direction of Britain's economic tanker.] Source

· “Bond Market Rout” in the UK https://wolfstreet.com/2025/01/09/bond-market-rout-in-the-uk-like-in-the-us-only-pushes-the-10-year-yield-into-low-end-of-old-normal-after-14-years-of-interest-rate-repression/

ASSET RICH...CASH POOR - Young families are stuck in their ‘little box’ starter-homes for eight months of the year, thanks to Britain's housing crisis

The arrival of a child is a good a reason as any to upsize, but this is no longer an option for many ‘second steppers’. A quarter of the English populace, around 14.1 million people, said insecure housing had led them to put their lives on hold, with the figure rising to more than two fifths of adults under 35. The survey, by the Hyde Group housing association, comes as new numbers from the ONS show that last year rents went up by 6.1% in England, the biggest jump ever.

Andy Hulme, the boss of Hyde Group, said: "When more than four in 10 adults aged under 35 are telling us they are putting off starting a family because they aren't sure where they can live, the main political parties have to start listening." But of course, they won't because it's beyond government's powers to change the endemic housing crisis in Britain 2025. Source

Millions of people have delayed starting a family because of housing crisis https://www.mirror.co.uk/money/millions-people-delayed-starting-family-31901691

BRITAIN'S COST OF LIVING CRISIS - One in six workers are skipping meals to make ends meet, says TUC

Highlighting the impact of the cost of living crisis on working households, figures from the Trades Union Congress (TUC) showed 17% of full- or part-time workers had skipped a meal to reduce their spending in the past three months. The Post Office, said separately, that cash withdrawals at its branches topped £1bn in December, the first time on record that this has happened in a single month, as people relied on cash to manage budgets.

This is good news for monetary controls because sovereign money is free from the banksters' grip and needs to increase substantially to correct the current 97-3 per cent ratio. BOOM writes often about this important economic lever encouraging the increased use of cash for very good economic reasons.

Keir Starmer’s government is coming under mounting pressure to find ways to grow the economy after recent turbulence in the financial markets which sent the UK’s borrowing costs to the highest levels in decades. The chancellor, 'Rachel from Accounts', has asked her cabinet colleagues to draft plans for boosting growth amid concerns that the rise in borrowing costs, alongside a weak outlook for the economy and stubborn inflation, could force her to break her own fiscal rules. [Ed: She is kicking a dead horse, or parrot if your prefer]

The TUC said real wages had grown by only 0.3% a year in 14 years of Tory misrule. At the same time, in-work poverty rose sharply, while the number of people with insecure jobs soared by one million between 2011 and 2023 to 4.1 million. Sources

Britain's housing crisis (The Guardian)

Cost of Living crisis (The Guardian)

SHOCK REVELATION: Britain Doesn’t Have Enough Workers to Build Labour’s 1.5 Million New Homes! [Ed: A home or a tacky box?)

In a shocking revelation that promises to knock everyone over backwards with disbelief, Britain's building industry’s leaders have warned that Britain doesn’t have enough construction workers to create the 1.5 million new homes Labour has insisted it’s going to have built in five years. Labour must build 2.5 homes a minute to meet ‘pie in the sky’ targets . Alarm bells sound over ‘absolutely impossible’ aim of delivering 300,000 properties a year.

Tens of thousands of new recruits are needed for bricklaying, groundworks and carpentry to get anywhere near the target, they told the BBC. The Home Builders Federation (HBF), along with the largest housebuilder, Barratt Redrow said skills shortages, ageing workers and Brexit were some of the factors behind the shrinking workforce. The Government confirmed there was a “dire shortage” of construction workers but said it was “taking steps to rectify” the problem.

Last week, Prime Minister, Keir Starmer repeated the pledge he made soon after taking power to deliver 1.5 million new homes in England by 2029. The pledge means 300,000 new homes a year, ratcheting up from the current figure of about 220,000. But for every 10,000 new homes to be built, the sector needs about 30,000 new recruits across 12 trades, according to the HBF, the trade body for the house building industry in England and Wales.

Based on the Government’s plans, the estimated number of new workers required for some common trades, for example, would be:

20,000 bricklayers

2,400 plumbers

8,000 carpenters

3,200 plasterers

20,000 groundworkers

1,200 tilers

2,400 electricians

2,400 roofers

480 engineers

When asked if there were enough workers currently to build the extra homes, David Thomas, Chief Executive of Barratt Redrow, said: “The short answer is no.” Of course, if Britain had unlimited suitable land and services, and a vast pool of currently unemployed, but well trained workers champing at the bit to get stuck in, the story might be different. But let’s not forget this is a government expecting simultaneously to carpet the country with solar farms and wind turbines, and also supercharge the manufacturing and installation of heat pumps as well as car charging points. [Ed: In your dreams!]

Millions of people out of work, and with no intention of going back to work, is part of the problem but so is the shortage of skills. Barratt Redrow boss Mr. Thomas said recruitment had not been helped by a drive in past decades to encourage young people into further education rather than trades. “If you go back to the 60s and 70s, I think parents, teachers and the government were very happy with the idea that people learned trades – electricians, plumbers, bricklayers,” he said.

The average rates of pay for these jobs “are high” but the issue was “more about availability of labour with skills”, he said. The Telegraph covers the same story, pointing out that 2.5 new homes would need to be completed every minute. Nonetheless, Matthew Pennycook, the housing minister, has already admitted that delivering the manifesto pledge is “more difficult than expected”, but remained “convinced” it is achievable. [Ed: but on what basis is this fantasy projection based? Words are cheap]

John Cooper, of snagging firm 'New Home Quality Control', said the drive to build will cause quality control to slip. He said: “New builds are in such a bad state already as there aren’t enough good quality tradesmen out there to cope. So you can only imagine the whole world of mess we’ll be in when housebuilding increases to this degree. I don’t see a good end coming to this at all – it’s only going to go downhill. The Government hasn’t thought about how these houses are going to get built."

Then there’s the problem of how building firms can fund the construction projects: Gareth Belsham, Director of Bloom Building Consultancy, said: “Housebuilding is stuck in reverse. Residential construction has contracted for two months in a row and November’s decline was the fastest seen since summer. With residential developers still chafing at high interest rates – which make it more expensive for them to buy land and build homes – and patchy consumer demand, the Government’s promise is looking ever more pie in the sky.”

There are plenty of other problems, among them an ageing workforce. The best prediction is that 1.12 million more homes might be built by the end of this Parliament, but it’s anyone’s guess whether they’ll be up to scratch. They’ll also add massively to the load on providing utilities, communications and meeting environmental regulations. It’s not always possible to predict the future, but in this case it’s hardly a challenge. Labour’s comedy house building target is already irrevocably doomed.

Sources

Read the Daily Telegraph’s story.

How do we bring joy this Christmas? Build homes, mend potholes, restore trust Torsten Bell. But when trust is lost it’s almost impossible to recover.

The British public has witnessed elite failure on a colossal scale. When The People witness the economy stagnate, and public services collapse it’s no surprise political trust is low and apathy high; the Guardian reports.

Leaseholders are in a desparate state with cladding bills and mould - welcome to life in a British leasehold flat.

STOP PRESS – STORM DARRAGH HAS LEFT BRITAIN'S BIGGEST SOLAR FARM IN PIECES (December 10, 2024)

Just as well we don’t rely on renewables for our electricity supplies then!

Sources

Owners of a solar farm torn to pieces were among those counting the cost of killer Storm Darragh - as recovery work was ongoing https://www.msn.com/en-gb/news/uknews/storm-darragh-leaves-uk-s-biggest-solar-farm-in-pieces/ar-AA1vyCVI

I wonder if the new storm this week will do even more damage? Storm Éowyn brings 90mph winds as it starts to impact the UK https://www.metoffice.gov.uk/about-us/news-and-media/media-centre/weather-and-climate-news/2025/storm-eowyn-brings-90mph-winds-as-it-starts-to-impact-the-uk

NEWS FLASH – 'RACHEL FROM ACCOUNTS' STRIKES AGAIN! Businesses are cutting jobs at the fastest pace in four years following Labour’s record tax-raising Budget

A closely-watched survey showed bosses are preparing for “worse to come” in 2025 amid a “triple whammy of gloomy news” that has seen growth grind to a halt and price rises gather pace. Economists said companies were responding to the Chancellor’s £40 billion tax rise with a marked pull-back in hiring.

Excluding the scamdemic, it was the fastest pace of job shedding since the global financial crisis in 2009. Source

Chris Williamson, the Chief Business Economist at S&P Global Intelligence, said: “Economic growth momentum has been lost since the robust expansion seen earlier in the year” https://dailysceptic.org/2024/12/16/rachel-from-accounts-strikes-again-hiring-plummets-after-record-tax-raid/

IS BRITAIN ON THE BRINK? MARK STYNE ASKS PERTINENT QESTIONS

FUN TIDBIT – HOLLYWOOD CELBRITIES ARE AFIRE - KARMA ANYONE?

The Apostle Peter gave a warning: "For they deliberately ignore this fact, that long ago there were heavens and an earth standing firmly out of water and in the midst of water by the word of God; and that by those means the world of that time suffered destruction when it was flooded with water. But by the same word the heavens and the earth that now exist are reserved for fire and are being kept until the day of judgment and of destruction of the ungodly people." [2 Peter 3:5-7]

KARMA IS A BITCH! "REVENGE IS MINE SAITH THE LORD"

THOUGHT FOR THE WEEK – WILL THE NET ZERO NONSENSE END IN 2025? Will SS-Oberst-Gruppenführer Be Deposed In 2025? Will The "Far Right" Prevail In 2025?

According to Mr. Trump this Asshole has had it good and proper!

THE DARK FINANCIAL TENTACLES OF THE GREEN BLOB helped to empower the mainstream media, brainwash young children, fund large areas of climate pseudoscience, initiate and finance lawfare operations, and bankroll countless ‘grassroots’ agitprop operations. Source

How the Blob Sneaks Net Zero Amendments into British Laws https://dailysceptic.org/2024/12/19/how-the-blob-sneaks-net-zero-amendments-into-british-laws/

GERMANY 2025 – THE SAGA OF A PROUD COUNTRY WHICH DESTROYED ITSELF; A BEDTIME STORY: [Direct from the Daily Sceptic - https://dailysceptic.org/2024/12/27/germanys-economic-and-political-suicide/

“Once upon a time there lived a country that was the envy of the world. It was among the world’s pre-eminent producers of manufactured goods. From chemicals and pharmaceuticals, to precision engineering, and the brewing of beer, it was second to none. Its people’s work skills, industriousness and discipline became the national hallmark of civilisational success. The country gained fame and fortune in bringing the luxuries of fine automobiles to the world’s rich and aspiring middle classes.

Alas, a blight visited that once great country not more than a score of years ago, though its destructive seed had been planted earlier. It was not some external force or act of God. Rather it was a sickness of the mind, a debilitating disease of the soul, that vexed that country’s ruling class. In restless search for virtue, the country’s rulers paid obeisance to the Goddess Gaia and promised the nation’s blood and treasure to satiate her inviolable sovereignty over her earthly domains.

This is a tale of woe and misery. Last Christmas was not one of unalloyed merry times and good cheer. And while beer was drunk and dinners eaten in many a hearth and eating place, the lifeblood of that nation was constricted and its breathing blocked by a cursed phlegm as normal life might resume in the New Year. Within the fateful score of years of becoming afflicted by the primordial cult of Gaia, the world’s envy has now become a sad basket case. Its economy has been tarnished as “the sick man of Europe”."

AND Britain is not far behind. It's not only Germany's economy that’s in trouble. Germany’s social structures are falling apart at the seams: “Caught on Camera: Left-Wing Politician Assaulted AfD Member as Germany Funds and Enables Violence Against Conservatives.” Source

Germany News | German President Dissolves Parliament For February 23 Snap Elections https://www.newsweek.com/chancellor-olaf-scholz-germany-parliament-frank-walter-steinmeier-2006591

BREAKING NEWS: Don't forget to follow this link at UK Column which is a truly independent, multimedia, and real-news website: supported by its members

GEN Z HAS NO INTEREST IN ANY FORM OF WARFARE [Via ZeroHedge]

It was different in my day when we won the peace (for a while anyway)

BUT no peace movement is in sight this time and this might be why: Some 10,000 soldiers, sailors and aviators are medically unfit to serve in combat, while another 15,000 can only go to war under certain circumstances. Restrictions include the weather being right and not being exposed to too much noise.

In the army, nearly a quarter of all soldiers and officers are not able to fight without restrictions - over 16,000 are "medically not deployable" or "medically limited deployable" out of 71,340 active personnel. In the navy, some 3,000 sailors cannot serve in active combat under any circumstances. Source

· One fifth of British armed forces 'unfit to fight', Ministry of Defence admits https://www.lbc.co.uk/news/fifth-british-armed-forces-unfit-to-fight-ministry-defence/

DESPATCHES FROM THE FRONTLINE - The head of NATO, Mark Rutte is calling on world leaders to “step up, not scale back” support for Ukraine,

Mark Rutte says it is important to “change the trajectory of the war”, warning that the front line is moving in the wrong direction. Rutte says there are three important reasons to do this.

First, for Ukraine itself, Rutte says we cannot allow one country invading another country and trying to colonise it in the 21st century.

Second, because China, North Korea, Iran and Russia are working together. A ‘bad deal’, would mean the president of Russia “high-fiving” with the leaders of North Korea, Iran and China, Rutte says.

Third, if Ukraine were to lose the war, NATO members would face “trillions” of extra spending to bolster their military, a “much, much higher price” than is being contemplated today.

Rutte adds that there is a commitment that Ukraine will become a member of Nato.And if Vladimir Putin can be brought to the negotiating table, the important thing is to ensure a “sustainable peace”, Rutte says, and not repeat the peace talks of Minsk in 2014.

[Ed: What Rutte omits is that the Minsk 2014 peace talks were torpedoed by the evil Nuland and Obama!]

Sources

Russia-Ukraine war in 2024; the ‘all-encompassing’ war nears three years with Ukrainian soldiers losing morale and territory https://www.aljazeera.com/gallery/2024/12/27/photos-russia-ukraine-war-in-2024

INFLATION MONITOR

Britain's inflation unexpectedly dipped last month, while the closely watched core rate, which strips out volatile energy and food costs, fell more than expected. The consumer prices index rose by 2.5% in the 12 months to December, down from 2.6% in November, according to the Office for National Statistics. Economists had expected inflation to stay steady at 2.6%.

This is welcome news for the Bank of England, whose target is to keep inflation at 2% “over the medium term”in the next two years. There are worrying signs in the bond markets, alarming investors and creating headaches for finance ministers, including the Chancellor, 'Rachel from Accounts'.

The yields, or interest rates, on sovereign debt from the US, the UK and some eurozone countries has been rising in recent weeks, as bond prices have fallen. Earlier this week, the yield on US 30-year Treasuries rose to its highest level in more than a year, and yesterday the yield on 10-year Treasuries climbed six basis points to 4.69% and spooking Wall Street and prompting stocks to slide.

UK debt (Gilts) has fallen out of favour with investors, on fears that economic growth will be weaker than expected. This has pushed up Britain’s borrowing costs, with the yield on 30-year UK gilts hitting 5.242% on Tuesday, the highest in 27 years, and above the peak reached after Liz Truss’s mini-budget in 2022 sparked turmoil in financial markets.

GILT YIELDS ARE SURGING, straining government finances and raising fears of tax rises or spending cuts. But is this a British-specific problem? And will the Bank of England be forced to respond? However, economists and the Bank of England expect inflation to pick up again in the coming months as the impact of higher employer National Insurance and tariffs begins to be felt.

Traders have raised their hopes of more monetary easing following the weak growth data, with markets now pricing in two to three 25 basis point cuts for 2025. The big picture is that Britain remains stuck in neutral, with GDP flat in the three months to November. Output growth was also zero in the third quarter, sharply slowing from the 0.4% expansion in Q2 and the 0.7% growth in Q1.

NET ZERO INSANITY - Mass Exodus of Big Banks from the ‘Net-Zero Bank Climate Alliance’ (NZBA)

THE WORM IS TURNING: In case you missed it: Sorry Green Energy Fans, Net Zero Is a Very Unlikely Outcome. Citigroup, BofA, and Morgan Stanley join Vanguard, JPMorgan, BlackRock, State Street, Goldman Sachs and Wells Fargo are leaving; the Net-Zero Bank Alliance Has Collapsed. The NZBA alliance is part of the United Nations “Glasgow Financial Alliance for Net Zero” effort to conscript private capital to drive the left’s climate goals. It was spearheaded by former Bank of England Governor Mark Carney in 2021. That was the year of peak climate arm-twisting.

Automakers are slowing their electric vehicle production plans. Utilities are extending the lifespan of coal plants to keep the lights on. Off-shore wind projects are being cancelled because they aren’t economic. Even California last month indefinitely delayed its plan to shut down a giant natural gas storage facility. Sources

The climate policy retreat is accelerating https://mishtalk.com/economics/a-mass-exodus-of-big-banks-from-the-net-zero-bank-climate-alliance/

The Collapse of Green Finance Shows Net Zero is Dying [by Ben Pile] https://dailysceptic.org/2025/01/03/the-collapse-of-green-finance-shows-net-zero-is-dying/

BOOM covered it this week:

USA; World Champions at Climate Hypocrisy & World Champions of Global Oil Production – US Banks Pull the Plug on Climate Activism – Climate and Energy Facts; Who Needs Them? - [01-21-25]

·Hat Tip to my colleague at BOOM Fin4ance and Economics Substack (Subscribe for Free) - also on LinkedIn and WordPress. Covid Medical News Network CMN News BOOM Blog and All Editorials (over 5 years) at BOOM Finance and Economics | Designed for Critical Thinkers — UPDATED WEEKLY (WordPress.com)

AND, furthermore Oxfordshire’s Green Lunatics Are At It Again! The fuss has only just died down since the County Council’s experiment with Low Traffic Neighbourhoods (LTN) and the so-called 15-minute city agenda drew worldwide attention. Now, the ambitious council has, according to the Oxford Mail, become “the first local authority in the U.K.” to commit “to go beyond [the] Net Zero target”, which it will achieve on behalf of its 750,000 population “by removing carbon emissions from the atmosphere”.

THE NET ZERO RIOTS

The Russian/British satirist and author Konstantin Kisin has popped up in a video chat with Youtuber and podcaster Chris Williamson with a damning verdict on Britain’s prospects while being led headlong into the crippling consequences of taxation and a Net Zero fantasy. Kisin starts right out with the view that “at the moment” Britain is “f***ed”.

They discuss the mass exodus of all those who have created, are creating and will create wealth. “This Government has decided that the people who it needs to tax are the businesses basically, particularly the smaller-size businesses.” Kisin describes the relentless increase of public, visible lawlessness, especially on the London Underground where staff and police stand by helplessly and haplessly as fare-dodging and crime goes untouched. Williamson asks Kisin why the fabric of Britain is disintegrating; Kisin says “ I think it’s partly because the economy isn’t growing” read on HERE.

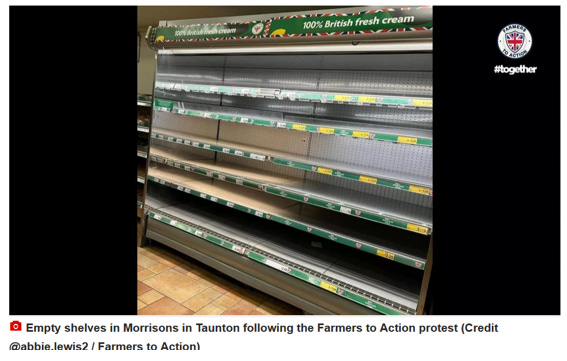

SURVIVAL MONITOR – A MESSAGE ABOUT 'JUST-IN-TIME' (JIT) FOOD SUPPLY CHAINS. This happened on Friday 13, 2025 in my home county of Somerset, UK. "A night of disruption unfolded in Bridgwater as tractors blockaded the Morrisons distribution centre, Willow Green, in protest against proposed changes to inheritance tax".

"For 12 hours in the freezing overnight temperatures, from Friday at 8pm through to Saturday morning, around 50 tractors lined the entrance, halting operations at the Morrisons distribution centre, Willow Green, in protest against proposed changes to inheritance tax. Willow Green is a sprawling 78-acre distribution hub just off the M5. It is central to Morrisons’ supply chain, handling over 2.1 million cases of fresh, frozen, and ambient goods each week. This facility serves nearly 80 stores, making it the lifeline of Morrisons’ operations in South West England. The blockade was aimed at sending a message to government about the potential consequences of closing family farms for good.

The protest, organised by 'Farmers to Action', wasn’t only about making headlines. It was a deliberate response to the Labour Party’s plan to extend inheritance tax to family farms valued at over £1 million, a proposal many farmers see as a direct threat to their way of life.

Paul Godden, a farmer from Glastonbury, explained: “We need to do something to show the country that if there’s no farmers, there’s no food, he said. “By blockading Morrisons today, we’re proving a point. If supermarkets can’t stock their shelves, people might realise the value of what we do.”

Paul Godden's sons, Brooks and Charlie, voiced their concerns about the long-term viability of farming. Brooks warned that inheritance tax could spell the end for small farms like theirs. He said “There’s no way to pay it without selling land or assets and you can’t farm without those.”

A government spokesperson defended the proposed changes, stating that they would impact only a small number of estates each year. “Our reforms will affect around 500 estates annually, with inheritance tax set at half the standard rate and a 10-year, interest-free repayment period,” he said. “This is a fair approach that balances the needs of public services with those of the farming community.” Source

Supermarket shelves left bare after Somerset farmers' protest.

NARRATIVE BATTLE – Britain could be self-sufficient in food if only HMG would get out of the way.

FINALLY - ARE YOU A USEFUL IDIOT? Spoiler: CRYPTO IS A BIG CON – AVOID

COMING NEXT:

BOOM's Weekly Global Review on Tuesday, January 28, 2025

The Financial Jigsaw Part 2 - DAVOS (paywall lifted) - Thursday, January 30, 2025

The Financial Jigsaw Part 2 – INFODEMIC - Saturday, February 1, 2025

REFERENCE - My Books: “The Financial Jigsaw” Parts 1 & 2 Scroll: https://www.researchgate.net/publication/358117070_THE_FINANCIAL_JIGSAW_-_PART_1_-_4th_Edition_2020 including regular updates.

![USA; World Champions at Climate Hypocrisy & World Champions of Global Oil Production – US Banks Pull the Plug on Climate Activism – Climate and Energy Facts; Who Needs Them? - [01-21-25]](https://substackcdn.com/image/fetch/$s_!dvtM!,w_1300,h_650,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F23986f47-9f64-4b9b-bd36-cb971e7e6d12_890x587.png)

A most welcome fact-packed summary of our human genius for destroying the beautiful, beneficial and life-supporting – thank you!

I almost feel sorry for the Hollywood, self-serving, deluded and totally ignorant who are unaware they have been flattered into self-destruction. Instead of fulfilling their democratic duty to keep their bureaucrats accountable, and thus their environment viable, they wallowed in their unkindness and stupidity. Now their homes are but uninsured ash - oh, well, what a shame, never mind.

I don't suppose any of those strapping young men who cross the Channel uninvited are skilled trades-people? We don't actually need any more unskilled young men - with increasing AI and therefore automation we only have loss of jobs – apart from the armed forces many of whom can only be deployed in quiet and hospitable areas. I understand that the more traditional types are used to protect many of our MPs, who, for some reason, are not as popular as they imagined with their constituents.

One of the most disheartening discoveries is that not only are our young working class unskilled but also our ruling class. It appears that our MPs rely on the 'advice' of civil servants who don't regard themselves as servants and take the advice (marketing and hard salesmanship) of various lobbyists. Unfortunately, their degrees in the classics ill equipping them for understanding business motivations, basic financial matters or scientific/technical issues. Much like our Hollywood elite, our civil servants seem dazzled by their superiority and by the flattery of the lobbyists.

Lastly, I am enjoying the POTUS' uplifting agenda – if only he wasn't firmly welded to the mRNA jabs. But maybe he will be able to encourage more useful industries and rely less on medical scams.

Thank you so much for a most enjoyable read. I sincerely hope you and yours are flourishing.