GEOPOLITICS & SA – EU Influence – Syrian Débâcle – McKinsey Escapes Again – Shipwrecks – BRICS+ Progress – SA Renewables – Global War? – Causes of Inflation - Letter from South Africa - [12-14-24]

During the late nights, try to walk in the empty streets with an empty mind! The ‘Light of Wisdom’ will soon accompany you!" [Mehmet Murat Ildan]

IS SOUTH AFRICA MAKING ENEMIES WITH THE WRONG COUNTRIES?

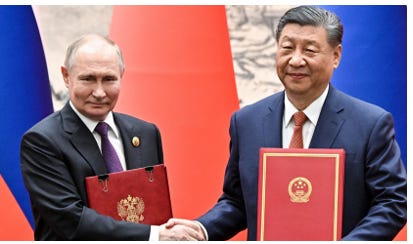

[Critique of edited extracts from Drikus Greyling • 6 December 2024]. South Africa might be alienating its current trading partners, including the United States and Europe, in preference for countries from which it does not benefit so much today, but in future this can and will change – “failing to plan is planning to fail” [Xerox Inc]

Business leaders, including economist Dawie Roodt, Sygnia CEO Magda Wierzycka, and former Eskom CEO Andre de Ruyter, said South Africa should carefully choose its partners {Ed: but at what future price?} Wierzycka said Donald Trump’s election as the next United States President poses a significant challenge for South Africa. “It is time to choose our allies carefully,” she said.

South Africa is a member of the BRICS+ alliance and the rapidly expanding Global South, which includes China and Russia. Iran is also closely linked to this group of countries, having attended a BRICS Summit and being part of the new BRICS+ grouping. Trump is not interested in South Africa even though it is the world's number one producer of platinum accounting for 74.3% of the world's crucial mineral.

Unless Trump wakes up to South Africa’s amazing prospects, it could be suspended from the benefits of the African Growth and Opportunity Act (AGOA). “Although largely insignificant, it tarnishes South Africa’s international standing, particularly when its bedfellow is grey-listed,” Wierzycka said. She advised South Africa’s government to follow India’s example and work much harder at staying neutral. “It is not what you say but what you do that matters,” she said.

De Ruyter, who currently works as a senior fellow at Yale’s Jackson School of Global Affairs, urged South Africa to support countries based on its economic interests rather than geopolitical issues. This might be mistaken advice in view of current world events. For any country, national security trumps economics every time. Cited, was former US Secretary of State Henry Kissinger, who’s trite comment omitted the obvious, “America has no permanent friends or enemies, only interests”. De Ruyter said a country should not support another country because of ‘friendship’. Instead, it should base its support on serving its interests.

“South Africa has many friends. However, we do not always strive to serve the country’s interests,” he said. Roodt warned that South Africa’s closeness to many rogue nations could significantly impact the country’s economy. He also warned that if South Africa is excluded from AGOA, it could negatively impact the country’s economy.

The United States is one of South Africa’s largest trading partners, and is running a trade surplus with the US. “We’re going to be the big losers here, but it doesn’t mean we’re going to stop trading with Americans,” he said. “Although the impact is not necessarily going to be that large on the South African economy, every time we shoot ourselves in the foot, it is bad for the economy.”

Roodt noted: South Africa is making economic enemies with the wrong countries. The Daily Investor analysed South Africa’s trading volumes with many prominent countries, which shows that it’s working with ‘less favourable’ groups. South Africa’s largest trading partners are China, the USA and Germany. These countries account for 24% of all South African exports and 30% of its imports.

As one of the BRICS+ nations, South Africa enjoys lowered tariffs primarily on agricultural and mining exports to China. The BRICS+ nations do not have a free trade agreement and rely on bilateral agreements between each country. BRICS+ objectives include removing trade barriers between members. However, there is no unified formal trade agreement between member countries - yet.

South Africa’s export trade with BRICS+ countries relies mostly on key mineral exports such as platinum, gold and agricultural goods, which generally fall under the raw materials category. Imports from BRICS+ nations such as India and China rely mostly on manufactured and refined goods including electronic equipment and oil. These goods require significant production input, with higher value-added, than their component raw materials. This has always been the sorry story of developing nations as they have been and are exploited by the western developed nations.

At the end of 2023, South Africa ran a trade deficit with every BRICS+ country, meaning it had negative net exports, thus South Africa paid these countries more for imports than it received for the products exported to them. South Africa is experiencing a deepening trade deficit with the BRICS+ countries. This is not necessarily detrimental when forging long-term trading agreements, especially with China, an economic giant now challenging the Anglosphere’s obsolescent warfare/welfare model.

At the end of 2023, South Africa had a ZAR146bn trade deficit with China and a ZAR39bn deficit with India. These graphs show net exports from South Africa for key trading partners over the last six years, 2018-23 (ZAR).

SA has wonderful opportunities to progress trade with China: “We encourage the Chinese companies to consider, very seriously consider, to move some of their assembly lines or value added in South Africa,” the Asian nation’s ambassador to South Africa, Wu Peng said at a Bloomberg interview in Johannesburg recently.

Trading with the United States and Germany. South Africa also has trade agreements with the European Union and the United States. These include the EU-SADC trade agreement with Europe and the AGOA agreement with the USA. South Africa benefits from lowered tariffs on various exports to the European Union with almost 99% exports to the EU offering the removal of customs duties but, (the catch): it must be within specified quantities.

The AGOA agreement removes approximately 6,800 US tariffs on qualifying Sub-Saharan African countries to promote Sub-Saharan African exports to the United States.

These trade agreements have had a positive impact on South Africa’s trade balance but recently less so and distorted by the 2020/1 global economic disruption:

The AGOA agreement has typical restrictive requirements for South Africa to maintain its ‘benefits’ from western countries. These include:

· Upholding a market economy protecting property rights with minimal government interference.

· Combating corruption and anti-bribery conventions.

· Not engaging in activities that undermine U.S. national security or foreign policy.

This last point has recently put the AGOA agreement in the spotlight, as South Africa underwent actions that jeopardised its EU and US trade agreements. Following the Russian-Ukraine war, Russian naval and cargo ships docked at Cape Town to replenish supplies, which drew obvious strong criticism from the USA. These events have been perceived as active support of Russia during its conflict with Ukraine, which the US has strongly opposed, as it would of course, using their mantra: “Do as it say, not as I do”

Additionally, South Africa initiated a legal case against Israel at the International Court of Justice after Israel initiated the Gaza genocide. The United States owns its proxy, Israel (or vice versa?), having strongly criticised South Africa for standing up to the Gaza genocide among other human rights abuses. White House National Security Council spokesman, John Kirby at the time said, “This submission is meritless, counterproductive, and without any basis in fact.” He would say that wouldn’t he? The hegemon brookes no opposition but this is now being challenged by the Global South multipolar emerging world!

South Africa’s open support for US chosen ‘enemies’ risks the AGOA agreement and, by extension, favourable trade with the US and potentially even the EU. So Jaco’s proposition is to sell out morality, right, and justice for money (a typical American trait)! [Hat Tip to the Anglophile, Jaco Kleynhans for his post on this issue that sparked my critique analysis. Although he is pro-US, even so his trade argument is valid but it’s not the most vital of considerations]

[Editor’s Note: It’s the age-old problem for any country when ‘trading’ with the enemy. Jaco believes that Russia is the enemy, I choose to differ, given what my research has exposed about the US policy of "Full Spectrum Dominance" but this discussion must be left for another day.] STAY WITH IT SOUTH AFRICA!

THE EU REMAINS INFLUENTIAL IN AFRICA MAINLY THROUGH EXPLOITATIVE FINANCIAL CONTROLS AND MILITARY OPERATIONS

External Debt in South Africa increased to US$164bn in the second quarter of 2024 from US$158bn in the first quarter of 2024. External Debt in South Africa averaged US$118bn 2002-24, reaching an all time high of US$185bn in the fourth quarter of 2019 and a record low of US$332bn in the first quarter of 2003. source: South African Reserve Bank

South African External Debt 1994-2024: Total external debt is debt owed to non-residents repayable in currency, goods, or services. Total external debt is the sum of public, publicly guaranteed, and private non-guaranteed long-term debt, use of IMF credit, short-term debt, and the World Bank (2022 US$53,430,459). Short-term debt includes all debt having an original maturity of one year or less and interest in arrears on long-term debt. Data are in current U.S. dollars.

· South Africa external debt for 2022 was $172bn, a 1.59% increase from 2021.

· South Africa external debt for 2021 was $169bn, a 3.41% decline from 2020.

· South Africa external debt for 2020 was $175bn, a 8.03% decline from 2019.

· South Africa external debt for 2019 was $190bn, a 5.86% increase from 2018.

The Rothschild-controlled Bank for International Settlements (BIS), the Central Bank of Central Banks, controlling more than 90% of the worldwide transnational monetary flow, and except for some minor central banks, is in control of them all, including the Chinese and the Russian central banks.

The colonial times of Europe have become part of the European culture. Even though African and Latin American colonies were “liberated” in Africa in the 1950s-60s, and in Latin America in the 19th Century, none of those so called “independent countries” is really free. They are all under modern financial and economic colonisation, aka, exploitation, predominantly by Europe in Africa, and by the US in Latin America. The former British Empire moved across the Atlantic, centred in Washington, and resides in 14 former colonial islands as tax havens.

Case in point is France with the most shameless exploitation of their 14 former “official” African French colonies, through the so-called Franc CFA (Communauté Financière Africaine, i.e. “African Financial Community” in English). The currency is “guaranteed” (i.e. controlled) in 80% of countries by the Banque de France. So, these countries still do not have any autonomy in deciding over the economy by adjusting their currencies, as would be normal for most other countries (except for those attached to the Euro).

Many West African governments instigated movements for monetary independence but did not survive for long, likeThomas Sankara, former Prime Minister of Burkina Faso, who was assassinated in 1987, after his serious attempts at achieving financial and monetary autonomy for all French colonies. There are many examples like Lybia, Lebanon et al, and Syria today.

In some philosophies, the rapid descent of Europe into oblivion would be called “karma.” The faster the EU collapses, the better off will be African countries and Romania, Hungary, and many others, who so far have not seriously challenge the EU, fearing potential “consequences.”

Neutrality and Sovereignty are crucial if African countries, and specifically South Africa, are to develop their economies through the BRICS+ with their various development banks supporting the multipolar New World Order emerging in the next five years. The only obstacle is the USA and UK’s reluctance to release their grip on the Global (Western) Financial System. However, none of those so called “independent countries” is really free, including South Africa. Source

Europe, especially the European Union (EU), is a Washington construct. To be sure, the EU never was a European idea https://www.globalresearch.ca/romania-coup-detat-instigated-by-the-european-union/5874549

STOP PRESS – THE SYRIAN DÉBÂCLE

THE TOTAL DESTABILISATION OF SYRIA, with heavy CIA-MI6 input, is now proceeding in real time, and is a carefully engineered gambit to undermine BRICS+ and indirectly impacting South Africa. It proceeds in parallel to Pashinyan removing Armenia from the CSTO based on a US promise to support Yerevan in a possible new clash with Baku; India being encouraged to ramp up a weapons race with Pakistan; and an across-the-board intimidation of Iran.

So this is also a war to destabilise the International North South Transportation Corridor (INSTC), of which the three major protagonists are BRICS+ members Russia, Iran and India. The INSTC is geopolitical risk-free. It’s a top BRICS+ corridor-in-the-making, it carries the potential to become even more effective than several of China’s cross-Heartland corridors in the Belt and Road Initiative (BRI).

Turkiye under Erdogan, as usual, is playing a double game. Rhetorically, Ankara stands by a genocide-free and sovereign Palestine. In practice, the Turkiye supports and funds a motley crew of Greater Idlibistan jihadis, trained by Ukrainian Neo-nazis in drone warfare and with weapons financed by Qatar. They marched on and conquered Aleppo and Hama but if this army of mercenaries were real followers of Islam, they would be marching in defense of Palestine.

At the same time, the real picture inside the corridors of power in Tehran is extremely murky. There are factions favouring the West, which clearly would have ramifications for the ‘Axis of Resistance’s’ ability to fight Tel Aviv. But on Lebanon, Syria never wavered. History explains why: from the point of view of Damascus, Lebanon historically remains a governorate, so Damascus is responsible for the security of Beirut.

History always teaches and Syria is now a West Asian Anabasis. Xenophon, a soldier and writer, tells how, in the 4th century B.C., an “expedition” (“anabasis”, in Ancient Greek) of 10,000 Greek mercenaries were engaged by ‘Cyrus the Younger’ against his brother Artaxerxes II, King of Persia, from Armenia to the Black Sea.

The expedition miserably failed and the painful return journey was endless. 2,400 years later, governments, armies, and mercenaries continue to plunge into the endless West Asia wars. Extracting themselves and finding peaceful coexistence is now even more impossible.

It feels like the BRICS+, especially China, haven’t learned a damn thing from Bandung in 1955 and how the Non-Alignment Movement (NAM) was neutralised. You can’t beat a pitiless hegemonic hydra with flower power. Source

How Syria’s rebels toppled the Assad regime, in 7 maps https://edition.cnn.com/world/middleeast/map-syria-civil-war-assad-dg/index.html

NEWS FLASH - McKinsey & Co escape again!

McKinsey & Co. has agreed to pay a fine of more than $122 million to resolve a felony bribery investigation stemming from its work in South Africa, federal prosecutors in New York said in a filing unsealed Thursday. It is the latest in a string of legal penalties for the global consulting firm which in recent years has agreed to pay about $1bn in settlements for its work with opioid manufacturers.

The fine was announced Thursday and was part of a deferred prosecution agreement that dismisses the bribery charge against the company after three years if McKinsey meets the conditions of the deal. Separately, a former McKinsey senior partner, Vikas Sagar, who was a leader in its Johannesburg office, pleaded guilty to conspiring to violate an anti-corruption law, prosecutors said.

The bribery investigation stemmed from work that McKinsey’s South African branch performed, starting more than a decade ago, for two state-owned companies: one overseeing the country’s run-down electric generating system, the other managing its freight rail system and ports. Mr. Sagar received confidential information about the companies that led to multimillion-dollar consulting contracts, and in return, some of the money McKinsey and its local partners made was routed to two officials as bribes, prosecutors said.

“McKinsey Africa participated in a years-long scheme to bribe government officials in South Africa and unlawfully obtained a series of highly lucrative consulting engagements that netted McKinsey $85 million in profits”, Damian Williams, the U.S. attorney for the Southern District of New York, said in a statement.

When The New York Times published a 2018 investigation into McKinsey’s contracts in South Africa, the firm’s questionable work there was considered its biggest mistake in its nearly 100-year history. But the next year, with the United States in the grip of an opioid epidemic, McKinsey’s extensive work to “turbocharge” sales at Purdue Pharma, the maker of the painkiller OxyContin, became public. McKinsey’s work with opioid makers is the focus of an ongoing federal criminal investigation.

McKinsey’s work for the two South African companies, Eskom, the power company, and Transnet, the freight rail company at one point brought in almost half of the Johannesburg office’s revenues. Despite McKinsey’s extensive consulting for Eskom, the country has been crippled by frequent blackouts in recent years but it seems are now resolved thanks to expert management.

The New York Times would like to hear from readers who want to share messages and materials with their journalists. nytimes.com/tips. South African law required McKinsey to hire local subcontractors, which have been the focus of criminal investigations in SA. In 2018 McKinsey’s managing partner apologized for the way the firm had handled the controversy over its work in South Africa, which came amid a corruption scandal that led the country’s president, Jacob Zuma to resign. McKinsey voluntarily returned about $100 million and fired Mr. Sagar.

At the time McKinsey was working with Transnet, Mr. Sagar arranged for a former McKinsey employee to ghostwrite an M.B.A. thesis for a senior Transnet executive, according to the former employee. “McKinsey is deeply remorseful that an employee of our firm engaged in corrupt conduct,” the firm said in a statement on Thursday, adding that it “will continue to cooperate” with South African and U.S. authorities in other ongoing investigations.”

Mr. Sagar, a native of India and a graduate of the University of Michigan and the Wharton School, was responsible for winning some of the biggest contracts in McKinsey’s South African office. Known for his showy, larger-than-life personality, Mr. Sagar drove a Porsche, carried a Louis Vuitton briefcase, and once ended a long business meeting by dancing on top of a conference table.

According to the documents unsealed Thursday, Mr. Sagar, 56, pleaded guilty in December 2022 to conspiring to violate the Foreign Corrupt Practices Act. The announcement did not say whether he had been sentenced. Source

Michael Forsythe a reporter on the investigations team at The Times, based in New York. He has written extensively about, and from, China. More about Michael Forsythe

THOUGHT FOR THE WEEK – What is “Wood, Iron and Steel?”

It’s the title of a first-of-its-kind book in South Africa on 60 known and unknown shipwrecks reflecting the maritime history of the Western Cape. Authors Bruce Henderson and Kelly Graham of Wreckless Marine, share their three-year-dive to map the seafloor. They describe how using cutting-edge scanning technology enabled them to view wrecks as never before, while on-site dives and extensive research helped them to provide a complete picture of these vessels.

Covering the period 1698 to 2009, each entry incorporates technical data, history, the circumstances of loss, and a description of the wreck in its current resting place, accompanied by photographs or paintings, and vivid multibeam sonar images of the wrecks on the seafloor. At R795 it looks like a steal for all those maritime treasure hunters who may well profit from the extensive research.

BREAKING SOUTH AFRICAN NEWS: BRICS+ SETTLEMENT TOOL TO ADVANCE undeterred by Trump's Threats, Vows Russian Deputy FM

Work on BRICS Settlement Tool to Proceed Despite Trump's Threats - Russian Deputy FM . On November 30, Trump threatened the BRICS countries that he would impose 100% duties on them if they did not abandon plans to create an alternative currency to the dollar. At the same time, Russian President, Vladimir Putin said earlier that it was too early to talk about the creation of a single BRICS currency.

(Ras al-Khaimah, UAE (Sputnik), The work on development of settlement tools for BRICS+ member states will continue despite US President-elect Donald Trump's threats to impose 100% tariffs against the organisation, Russian Deputy Foreign Minister Alexander Pankin told Sputnik on Friday. "This is a calculated platform opportunity. Of course the work on it will continue," Pankin said on the sidelines of the XVII Verona Eurasian Economic Forum in the UAE's emirate of Ras Al Khaimah.

G20 prepared for Trump’s ‘America First’ policy – South Africa. Cyril Ramaphosa says he has invited the US president-elect to play golf and talk about global matters. The G20 has enough “shock absorbers” in place to function effectively if Donald Trump pursues an ‘America First’ policy at the cost of international cooperation after taking office as US president, South African leader Cyril Ramaphosa has said.

He made the statement during the official launch of his country’s presidency of the Group of 20 major economies in Cape Town last Tuesday. Pretoria assumed the rotating leadership of the G20 this month, succeeding Brazil at the group’s November summit in Rio de Janeiro. The US is set to take over in December 2025. Source

Pepe Escobar: BRICS Make History - Can They Keep the Momentum? https://sputnikglobe.com/20241028/pepe-escobar-brics-make-history---can-they-keep-the-momentum-1120707386.html

SOUTH AFRICA AFFIRMS THAT BRICS+ ARE NOT CONSIDERING REPLACING THE US DOLLAR. Echoing this sentiment in response to Trump’s threat this week, South Africa’s government repeated that there are no plans to create a BRICS currency. “Recent misreporting has led to the incorrect narrative that BRICS is planning to create a new currency,” South Africa’s Department of International Relations and Cooperation said in a statement. “This is not the case. The discussions within BRICS focus on trading among member countries using their own national currencies.”

The bloc’s New Development Bank continues to rely on the US dollar for its investments, which have exceeded $30bn in member states and other developing economies, Dirco said.

“South Africa supports the increased use of national currencies in international trade and financial transactions to mitigate the impact of foreign exchange fluctuations, rather than focusing on de-dollarisation,” he said. “The strengthening of correspondent banking networks and the development of infrastructure for settlements in national currencies could further this aim.”

While a physical currency is out of the question, one of the BRICS members, Russia, has been pushing ahead with a new digital payments system for the bloc, called BRICS Pay, along with promoting the use of a BRICS digital currency. BRICS Pay was tested at the BRICS Business Forum in October.

The National Treasury said at the time that while “South Africa remains a keen observer of the work being done on BRICS Pay”, it had not committed to it in any way, as the country is still in the early stages of researching and analysing digital assets, stablecoins and Central Banks Digital Currencies (CBDCs). Sources

· New currency for South Africa, Russia, and China bites the dust https://businesstech.co.za/news/government/803267/new-currency-for-south-africa-russia-and-china-bites-the-dust/?utm_source=everlytic&utm_medium=newsletter&utm_campaign=businesstech

· Ramaphosa has promised to advance Africa and the Global South’s development priorities https://www.rt.com/africa/608781-south-africa-g20-trump-america-first-policy-policy-counter/?utm_source=substack&utm_medium=email

THIS RENEWABLE ENERGY COMPANY IS GENERATING 770 GWH of electricity annually for South Africa

Longyuan South Africa Renewables is playing a key role in South Africa’s green energy revolution through its two local wind power projects. According to David Dai, Business Development Manager for Longyuan South Africa Renewables, their wind power plants have produced an incredible 5,400 GWh of clean energy since they went into operation in 2017. Dai was speaking at a Longyuan South Africa Renewables event in Cape Town, where the company released a report on the work it is doing in South Africa’s renewable energy sector.

An Impressive power generation: Longyuan South Africa Renewables is a subsidiary of the China Longyuan Power Group Corporation, the world’s largest wind power operator and an affiliate of the Fortune Global 500 company China Energy Investment Corporation (CHN Energy). The company has the backing it needs to excel in South Africa, where it established the country’s two largest wind power projects. These projects are located in De Aar, Northern Cape, and have a combined generation capacity of 244.5 MW.

They comprise the De Aar 1 Maanhaarberg Wind Farm Facility (DA1) and the De Aar 2 North Wind Farm Facility (DA2) totalling 163 wind turbines. Construction on these wind farms began in 2015, and they entered operation two years later. “Since then, they have generated an impressive 5.4 billion kWh (5,400 GWh) of clean electricity, which is about 770 million kWh per year (770 GWh),” said Dai. This is equivalent to saving 215,800 tons of coal per year; an incredible milestone in South Africa’s path to sustainable energy.

SAC Think Tank report. Nelson Mandela University (NMU) Professor Arielle Liu was a key speaker at the event, and used the opportunity to reveal the findings of the latest SAC Think Tank report which assessed the status of, and issues in South Africa's renewable energy sector.

The report also examined the prospects for renewable energy development and gauged the adaptability of Chinese enterprises to support South Africa’s renewable energy goals. “The report provides strategies and development costs for future investors who want to land in South Africa,” said Liu, “This will help to promote future development and cooperation between South Africa and China.”

NMU Professor, Michelle Mey also took part in the event, and explained that each country has its own energy strengths. This includes the different national standards for renewable energy between South Africa and China, which “significantly impact project timelines and implementation”.

In China, renewable energy projects are implemented quickly while South Africa has a more complex regulatory environment that can slow the process. “Strategic alignment between South Africa and China on renewable energy projects can drive economic growth, social development, and environmental sustainability,” concluded Mey.

SURVIVAL MONITOR – AS GLOBAL TENSIONS ESCALATE, THE QUESTION OF SURVIVAL BECOMES PARAMOUNT.

Doug Casey from ‘International Man’ gives his view. Given the rising tensions, can individuals safeguard themselves against the literal and metaphorical fallout of a potential nuclear conflict? Doug Casey said: “Well, very clearly, the safest place to be is the Southern Hemisphere. Number one, there are very few nuclear targets in the Southern Hemisphere.”

“And number two, global weather systems somewhat insulate the Southern Hemisphere [because nuclear radiation remains in the northern hemisphere due to the Coriolis effect.] A [prudent] person, if he can afford it, should have a second home in South America, [sub-Saharan Africa], or the South Pacific. And, yes, I realise that’s not practical for most people. There will be no winners, and relatively few survivors, if our beloved leaders start WW3.

In the event the best assets would be a safe location, all manner of prepper stuff, gold, and perhaps Bitcoin. People will always need money, and these are the best monies in world. [Editor’s Note: The amount of money the US government spends on foreign aid, wars, the so-called intelligence community, and other aspects of foreign policy is measured in US$ trillions and ever-growing.]

It’s an established trend in motion that is accelerating, and now approaching a breaking point. Most people won’t be prepared for what might be coming in 2025. Source

WW3 could cause the most significant disaster since the 1930s https://www.theburningplatform.com/2024/11/27/doug-casey-on-the-growing-threat-of-nuclear-war/

INFLATION - What Causes Inflation and Price Increases?

Inflation appears as the rate at which the price of goods and services increases over time. It can affect nearly any product or service, including need-based expenses such as housing, food, medical care, and utilities, as well as want-based expenses such as cosmetics, automobiles, and jewelry.

Once inflation becomes prevalent throughout an economy, the expectation of further inflation becomes an overriding concern in the consciousness of consumers and businesses. Inflation can also be thought of as the devaluation of money. It can be a concern because it makes money saved in the present less valuable in the future. There are many potential root causes of inflation:

· Cost-push inflation

· Demand-pull inflation

· Built-in inflation

· The housing market

· Expansionary monetary and fiscal policy

· Monetary devaluation

Learn more about inflation and how to deal with rising prices. Solutions only arise after the subject is thoroughly understood https://www.investopedia.com/ask/answers/111314/what-causes-inflation-and-does-anyone-gain-it.asp

NARRATIVE BATTLE – A message from my consultancy firm

http://www.underco.co.uk/

FINALLY

COMING NEXT:

BOOM Weekly Global Review - Tuesday, December 17, 2024

The Financial Jigsaw Part 2 - Chapter 7 (35) – THE NEW BOSS – Saturday, December 21, 2024

REFERENCES

My Book: “The Financial Jigsaw” Parts 1 & 2 Scroll: https://www.researchgate.net/publication/358117070_THE_FINANCIAL_JIGSAW_-_PART_1_-_4th_Edition_2020 including regular updates.

BOOM Finance and Economics Substack (Subscribe for Free) - also on LinkedIn and WordPress. Plus Covid Medical News Network CMN News and BOOM Blog -- All Editorials (over 5 years) -- BOOM Finance and Economics | Designed for Critical Thinkers — UPDATED WEEKLY (wordpress.com)

I think that in measuring trade imballancies we should factor in the size of each economy relative to that imbalance. Which I hope they do before slapping tarrifs on everybody and everything.

In regard to Syria and other international news, there is an excellent podcast by a ‘former’ spook that is very well done. His name Is Mike Baker and the name of the podcast is The President’s Daily Brief. Let me know if you can’t find it and are interested.