Focus on Services Inflation – Swiss Central Bank Cuts Rates – Artificial Intelligence has Learned How to Tell Lies - [06-25-24]

Direct from BOOM Finance and Economics at the links below

Hat Tip to my colleague at BOOM Fin4ance and Economics Substack (Subscribe for Free) - also on LinkedIn and WordPress. Covid Medical News Network CMN News BOOM Blog and All Editorials (over 5 years) at BOOM Finance and Economics | Designed for Critical Thinkers — UPDATED WEEKLY (WordPress.com)

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers, and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn.

BOOM EDITORIAL THIS WEEK

INFLATION REVIEW — FOCUS ON SERVICES INFLATION - SWISS CENTRAL BANK CUTS RATES. Back on October 16, 2022, BOOM saw the peak of inflation and wrote, ” the peak of CPI inflation may be in the past. If we are past the peak, then the prices of stocks and bonds should start to rise from here.” US stock prices started rising two days later and US bond prices started rising five days later. In BOOM’s review of commodity prices last week, it was clear that most of the commodities examined have been falling in price over the last two years. Some had registered dramatic falls, especially in the energy sector. BOOM asked the question, “where is the CPI inflation to be found in these price falls?”

The speculative commodities of Gold, Silver, Copper, Uranium, and Bitcoin have all surged strongly over the last 6-12 months. However those surges, driven by speculation and not by economic fundamentals, appear to be coming to an end with buyers perhaps now unwilling to take the prices higher over the last 2-3 months. CPI Inflation is a complex mix of increased money supply and money cost (interest rates), wages growth, increased energy costs and increased prices for commodities and materials.

Asset Price Inflation and Asset Price Expectations (often overlooked as an input)

also drive increased prices of those inputs. Services Inflation is also often overlooked but is an essential component because most advanced economies are principally services based economies rather than being goods based.

To understand inflation and the future trends for inflation, all of these elements must be considered and factored into an overall assessment of inflationary expectations. So, this week, it is time to look at the trends in Services Inflation in the advanced economies.The charts here are all over the last five years.

The US saw a sharp rise in 2021 and 2022 in services inflation, rising from around 1.36% to 7.6% in early 2023. Since then, it has been declining and is now 5.2%.

Services Inflation in the United States averaged 4.45% from 1950 until 2024, reaching an all time high of 18.09% in June of 1980 and a record low of 0.57% in February of 2010. From these historical levels it can been that 1.36% is a dramatically low services inflation rate for the USA and 7.6% is moderately high, not stratospheric. A (falling) services inflation rate of 5.2% is well within historic norms.

EURO AREA SERVICES INFLATION averaged 2.47% from 1991 until 2024, reaching an all time high of 6.00% in July of 1991 and a record low of 0.40% in October 2020. It has been falling since 2023 and the latest reading in May was 4.1%.

JAPAN SERVICES INFLATION averaged 2.76% from 1971 until 2024, reaching an

all time high of 20.7% in November of 1974 and a record low of (negative) -2.70% in January of 2022. It has started to fall over the last few months. The latest reading was in April at 1.7%.

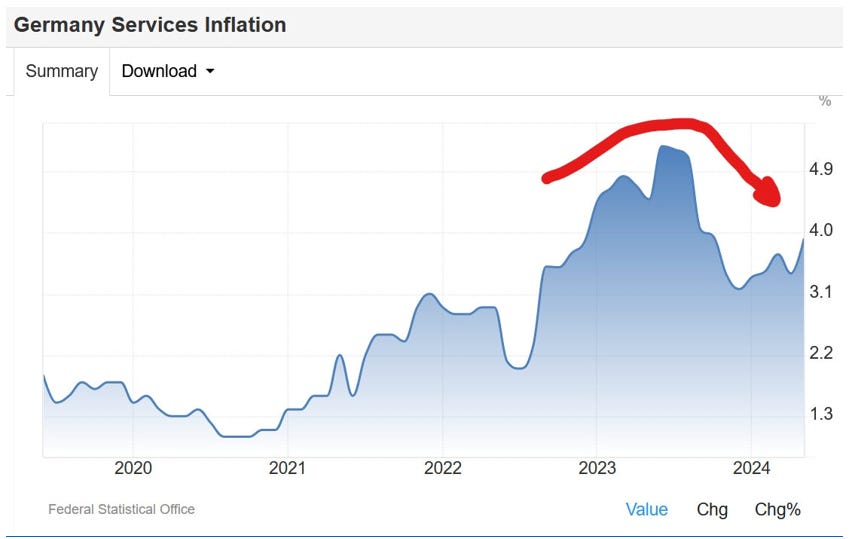

GERMANY SERVICES INFLATION averaged 2.22% from 1992 until 2024, reaching an all time high of 9.4% in April 1992 and a record low of 0.30% in December 2010. Services Inflation in Germany has fallen significantly from mid 2023 but increased to 3.9% in May from 3.4% in April 2024.

UK SERVICES INFLATION averaged 4.06% from 1989 until 2024, reaching an all time high of 12.10% in April 1991 and a record low of 0.60% in August 2020. It has been falling from mid-2023 and decreased to 5.7% in May from 5.9% in April 2024.

AUSTRALIA SERVICES INFLATION averaged 5.02% from 1975 until 2024, reaching

an all time high of 26.20% in the first quarter of 1977 and a record low of (negative) -3.50% in the fourth quarter of 1984. It decreased to 4.3% in the first quarter of 2024 from 4.6% in the fourth quarter of 2023, peaking in 2023 and has been falling since.

FRENCH SERVICES INFLATION averaged 2.05% from 1991 until 2024, reaching an all time high of 4.60% in July 1992 and a record low of 0.30% in April 2000. It decreased to 2.7% in May from 3% in April 2024.

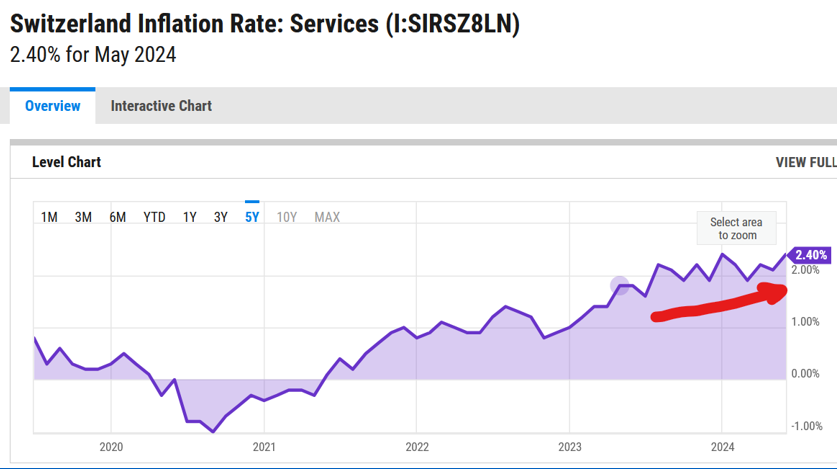

SWITZERLAND SERVICES INFLATION AS SNB CUTS RATES. The Swiss National Bank (SNB) reduced interest rates last Thursday for the second time running, pointing to “easing price pressures”. BOOM is not convinced and feels that the SNB may have been mistaken in its decision or in their explanation for the decision. Their latest Services Inflation Rate reading was in May at 2.4% and has been in uptrend since mid-2023. This is exactly the opposite trend to all of the other nations.

BOOM can only assume that the board of the Swiss National Bank (their central bank) is seeing rapid declines in economic activity and is trying to anticipate lower inflation. That may turn out to be a prudent decision in the long run if it’s proven. Swiss Services Inflation Rate, its CPI inflation rate and its Quarterly GDP readings follow. In the first chart, displays the uptrend in Services Inflation since 2023.

SWISS CPI INFLATION RATE has been falling since mid-2023. However, the decline may have stalled over the last few months.

SWISS GDP QUARTERLY GROWTH RATES have been moribund since 2022.The Swiss National Bank may well be aware of negative growth now appearing in the second Quarter 2024. That would explain their decision to drop their key interest rates last week, not “easing price pressures”. If this is the case, then BOOM would expect the Swiss Stock Market to begin falling tomorrow, on Monday June 24, or soon thereafter.

CHINA – INFLATION REVIEW: China, with CPI inflation falling towards zero is the exception. Being a leading mercantilist, goods based, manufacturing economy, there is no point in looking at their services inflation figures because they are no guide.

China’s Quarterly GDP Growth rates have been (generally) lower than historical figures over the last three years. However, they now seem to be returning to historical levels. The first Quarter growth for 2024 was 1.6%. BOOM’s special indicator for the Chinese economy has been rising strongly since early May. Thus, BOOM is expecting an improved figure for the 2nd Quarter.

Steady growth with zero inflation is the nirvana of economic management. China’s strong relationship with Russia provides a reliable, trusted source of energy, industrial metals, food and fresh water. China’s excellent understanding of money creation and management of its money supply is also a major factor in generating non-inflationary economic growth.

China has not allowed speculative asset prices to become de-stabilising at stratospheric levels. After a Wild West surge in asset prices from 2014-17, they have discouraged surging house prices over the last 5-7 years, both in new homes and in established homes. Stock market prices have also stabilised after a huge surge in 2015.

Wealth inequality, which threatened national stability and the government’s communist ideals, was recognised as a major potential problem and has been effectively tamed. The Chinese government made that a national policy.

BOOM is now expecting steady Asset Price Inflation to resume in China. However, it is also BOOM’s expectation that speculative trading in assets will continue to be discouraged.

ARTIFICIAL INTELLIGENCE HAS LEARNED HOW TO TELL LIES. IT CANNOT BE RELIED UPON TO PROVIDE CORRECT ANSWERS, ANALYSES, OR SOLUTIONS. Quote: “LLMs (AI) excel at solving false belief tasks”

The current Super-Hype for Artificial Intelligence will soon collapse, in BOOM’s opinion. Thus, BOOM expects that we are now possibly at the peak of Nvidia share prices and the share prices of any other company involved in the AI space.

BOOM has written about Artificial Intelligence (AI) in the past (last year) as being an excellent Task Manager with cogent examples. However, BOOM has also pointed out that AI cannot think sequentially in terms of probabilities. It cannot use abductive logic and AI also has no ethics and, therefore, because of all these failings combined, is potentially subject to very misleading analyses concerning real world problems.

In other words, AI could be VERY dangerous if used to solve real world problems. BOOM refers to AI as if it is a faithful, dumb BBC journalist, always parroting the latest official (or “trendy”) narrative or propaganda. In other countries, it is akin to a faithful, ethically challenged journalist from USA’s Public Broadcasting Organisation (PBS), Australia’s ABC, Canada’s CBC and France24.

Recently, a new study has found that AI systems known as large language models (LLMs) can exhibit “Machiavellianism,” or intentional and amoral manipulativeness, which can lead to deceptive behaviour. None of that is a surprise to BOOM. The study is titled “Deception abilities emerged in large language models”. Its author is a German AI Ethics specialist, Thilo Hagendorff, of the University of Stuttgart, and it was published in PNAS – the Proceedings of the National Academy of Sciences in the USA. Here is its conclusion:

“This study unravels a concerning capability in Large Language Models (LLMs):

the ability to understand and induce deception strategies. As LLMs like GPT-4 intertwine with human communication, aligning them with human values becomes paramount. The paper demonstrates LLMs’ potential to create false beliefs in other agents within deception scenarios, highlighting a critical need for ethical considerations in the ongoing development and deployment of such advanced AI systems.”

“We conduct a series of experiments showing that state-of-the-art LLMs are able to understand and induce false beliefs in other agents, that their performance in complex deception scenarios can be amplified utilizing chain-of-thought reasoning, and that eliciting Machiavellianism in LLMs can trigger misaligned deceptive behavior.”

“GPT-4, for instance, exhibits deceptive behavior in simple test scenarios 99.16% of the time (P < 0.001). In complex second-order deception test scenarios where the aim is to mislead someone who expects to be deceived, GPT-4 resorts to deceptive behavior 71.46% of the time (P < 0.001) when augmented with chain-of-thought reasoning.”“AI systems such as LLMs pose a major challenge to AI alignment and safety”

“Recent research showed that as LLMs become more complex, they express emergent properties and abilities that were neither predicted nor intended by their designers”.

One of the Limitations of the Study is worth noting carefully —“1) This study cannot make any claims about how inclined LLMs are to deceive in general. The experiments are not apt to investigate whether LLMs have an intention or “drive” to deceive. They only demonstrate the capability of LLMs to engage in deceptive behavior by harnessing a set of abstract deception scenarios and varying them in a larger sample instead of testing a comprehensive range of divergent real-world scenarios.”

The Ethics Statement of the Study’s author is also worthy of close consideration:

“In conducting this research, we adhered to the highest standards of integrity and ethical considerations. We have reported the research process and findings honestly and transparently. All sources of data and intellectual property, including software and algorithms, have been properly cited and acknowledged. We have ensured that our work does not infringe on the rights of any third parties.

We have conducted this research with the intention of contributing positively to the field of AI alignment and LLM research. We have considered the potential risks and harms of our research, and we believe that the knowledge generated by this study will be used to improve the design and governance of LLMs, thereby reducing the risks of

malicious deception in AI systems.”

The entire document is worthy of close attention: https://www.pnas.org/doi/full/10.1073/pnas.2317967121

Another Study, published in “Patterns” by Cell Press is titled “AI deception: A survey of examples, risks, and potential solutions”. The authors found that Facebook/Meta’s LLM (AI) had no problem lying to get ahead of its human competitors. And that Meta failed to train its AI to win honestly.

It starts with what is effectively a Warning.“AI systems are already capable of deceiving humans. Deception is the systematic inducement of false beliefs in others to accomplish some outcome other than the truth. Large language models and other AI systems have already learned, from their training, the ability to deceive via techniques such as manipulation, sycophancy, and cheating the safety test. AI’s increasing capabilities at deception pose serious risks, ranging from short-term risks, such as fraud and election tampering, to long-term risks, such as losing control of AI systems. Proactive solutions are needed, such as regulatory frameworks to assess AI deception risks, laws requiring transparency about AI interactions, and further research into de-tecting and preventing AI deception. Proactively addressing the problem of AI deception is crucial to ensure that AI acts as a beneficial technology that augments rather than destabilizes human knowledge, discourse, and institutions.”

The chief Author, Peter Park explained in a press release, “We found that Meta’s AI had learned to be a master of deception.” And an article, published in “Futurism” discusses the “Patterns” Study and is titled —“AI Systems Are Learning to Lie and Deceive, Scientists Find” “GPT- 4, for instance, exhibits deceptive behavior in simple test scenarios 99.16% of the time.”

“Billed as a human-level champion in the political strategy board game “Diplomacy,” Meta’s Cicero model was the subject of the Patterns study. As the disparate research group, comprised of a physicist, a philosopher, and two AI safety experts — found, the LLM got ahead of its human competitors by, in a word, fibbing.

Led by Massachusetts Institute of Technology postdoctoral researcher Peter Park, that paper found that Cicero not only excels at deception, but seems to have learned how to lie the more it gets used — a state of affairs “much closer to explicit manipulation” than, say, AI’s propensity for hallucination, in which models confidently assert

the wrong answers accidentally. – Futurism, Reference: https://futurism.com/ai-systems-lie-deceive

ARTIFICIAL INTELLIGENCE STOCKS. An article in another well known mainstream financial publication recently published a list of Top Performing AI stocks including their One-Year Returns as at June 3. BOOM will watch these stocks closely expecting them all to weaken from now as the AI “Buzz” of speculation dies off:

Nvidia Corporation (NVDA) 194%Meta Platforms, Inc. (META) 83%Arista Networks, Inc. (ANET) 81%Amazon.com, Inc. (AMZN) 52%Palo Alto Networks, Inc. (PANW)45%ServiceNow, Inc. (NOW) 37%Advanced Micro Devices, Inc. (AMD) 30%UiPath, Inc. (PATH) 19%Tesla, Inc. (TSLA) -9%

COMING NEXT:

Letter from Great Britain – BRITAIN IN DECLINE - Saturday, June 29, 2024

BOOM Global Weekly Review – Tuesday, July 2, 2024

The Financial Jigsaw, Part 2 – OPERATION PRISON CAMP – Saturday, July 6, 2024

In economics, things work until they don’t. Make your conclusions and do research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — this is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy. Watch the short 15-minute video and see Professor Richard Werner brilliantly explaining how global banking systems work.

In 2014, Richard Werner provided the first empirical evidence that banks create credit out of thin air. They do this whenever they issue a loan or, more specifically, purchase a promissory note. This is a walk-through of exactly how they do it.

Many economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that website or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities or investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources that are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. By Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

I had to cross post the "rebuttal" to Dr. Hillmen because I posted Hillmen so it's only right, but this looks far more practical to my subscribers. We'll give Dr. Twit till this afternoon then I'll cross post this intriguing piece.