BOOM Market Signals – The Mystery Stock – Tariff Wars Will Not Help the US Economy – Rare Earth Companies Are Not Rare - [03-18-25]

Direct from BOOM Finance and Economics

Hat Tip to my colleague at BOOM Finance and Economics Substack (Subscription is Free). Also from my colleague at Covid Medical News Network CMN News (Subscription is Free)

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over many years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers, and academics.

BOOM EDITORIAL THIS WEEK

BOOM MARKET SIGNALS. BOOM is not a stock tip sheet. It does not make investment or trading recommendations. It does not give investment advice. However, BOOM does report market signals. Regular readers will be familiar with it. BOOM reported:

the coming rise of the Chinese stock markets in late 2024

the end of the US Bond bear market in October 2022

the bottom of the US stock markets in October 2022 at the peak of CPI inflation

the fall of the US Dollar in late December 2024

the correction in US stocks, again in late December 2024

the collapse of alternative energy stocks three years ago

the collapse of electric car stocks three years ago

the end of the AI Delusion bull market “Artificial Intelligence is Not Intelligent” (January 26 editorial)

the recent collapse of Tesla shares last week

On December 22, 2024, just before Christmas, BOOM wrote “... it is wise to pay close attention to any extraordinary events which may indicate a situation of change and increased alarm. Those circumstances currently prevail in the US stock markets." BOOM is becoming increasingly concerned that we are witnessing what may be the beginning of a Selloff.

Last week, on Sunday morning, the BOOM editorial noted regarding Tesla: “Tesla is the only EV company in the West that has any chance of survival in BOOM’s opinion. But it seems to be vastly overvalued by the market.” During Monday’s trading session, its shares collapsed by 16% from the closing price on the previous Friday. That is an extraordinary fall in just one day. Reality Bites.

NIKOLA TRUCKS CRASH. The most recent EV company in the US to hit the wall is Nikola. On February 20, the Nikola Corporation issued a press release stating that it had filed for Chapter 11 in the US Bankruptcy Court for the District of Delaware. It listed in its petition, assets between $500 million and $1bn and liabilities between $1bn and $10bn . It noted that $47 million in cash-on-hand to fund activities, but BOOM suspects that those cash reserves were dwindling rapidly.

BOOM has stated, in many previous editorials, that the entire alternative energy sector is not commercially viable in the long run and that includes the EV market (maybe with the possible exception of Tesla which may become a niche manufacturer). In the West, companies have to prove themselves commercially viable by making profits. In China, it's different; thus, the Chinese EV industry can continue to make financial losses for a much longer period. The Nikola Press Release stated:

“Like other companies in the electric vehicle industry, we have faced various market and macroeconomic factors that have impacted our ability to operate. In recent months, we have taken numerous actions to raise capital, reduce our liabilities, clean up our balance sheet and preserve cash to sustain our operations. Unfortunately, our very best efforts have not been enough to overcome these significant challenges, and the Board has determined that Chapter 11 represents the best possible path forward …”

On June 9, 2020, Nikola shares traded at their all-time high price of US$2,819.70 and finished that day at $2,391.90. Since then, they have progressively fallen to their last traded price of 13 cents. THAT is a monumental CRASH in market value. At one point, Nikola was valued by the market at $30bn Market Capitalisation. The shareholders have been slaughtered. The Stock Code is NKLAQ on the US OTC Market.

'STANDARD and POORS 500 '(S&P 500), the US STOCK INDEX, sparked BOOM’S Market Signal comment on December 22, 2024: “BOOM is becoming increasingly concerned that we are witnessing what may be the beginning of a Selloff.”

US DOLLAR SELL OFF — US DOLLAR INDEX (Stock Code UUP). On February 2, just over 3 weeks ago, BOOM stated: “BOOM will watch closely from here for ongoing US Dollar weakness.” On December 22, 2024: “BOOM is becoming increasingly concerned that we are witnessing what may be the beginning of a Selloff.”

SHANGHAI STOCK EXCHANGE COMPOSITE INDEX — RISING. In August last year, BOOM forecast the coming rise in Chinese stocks.

HONG KONG HANG SENG STOCK INDEX — RISING

BITCOIN — GRAYSCALE BITCOIN TRUST — GBTC. On December 22, 2024, BOOM wrote — “BOOM’s analysis shows that the Post-Trump election exuberance in Bitcoin/Crypto may be coming to an end. Honeymoons don’t last forever.” Bitcoin started falling three weeks later and has continued to fall.

THE END OF THE ARTIFICIAL INTELLIGENCE BULL MARKET. In BOOM’s January 26 Editorial, Pathways to Madness, BOOM stated: “BOOM is sceptical about the claims being made about Artificial Intelligence (AI). It embodies two great threats to our civil societies: Technocracy and Transhumanism. BOOM likes to call it "Artificial Non-Intelligence.” And, “BOOM is sceptical about Artificial Intelligence (AI) and about the claims being made for it.” The two biggest Artificial Intelligence ETFs (BOTZ and ROBO) and NVDIA shares (NVDA) began to fall immediately.

THE MYSTERY STOCK – HOW LARGE COMPANIES FAIL. Today, there is a mystery stock which BOOM finds particularly intriguing. This US company has one of the most recognised Global Brands in history. The Brand is known to possibly everyone on the planet, almost as well-known as US Brands such as, Coca Cola, IBM, General Motors, and General Electric.

The company continues to sell its products and services in 160 nations worldwide. It was founded almost 120 years ago and listed on the New York Stock Exchange way back in the early 1960’s. Its peak market capitalisation was around US$40bn but today, the market values it at well below $1bn, despite the fact that it enjoys annual revenues over $6bn. Net profit, however, has fallen below the Zero line, thus the company is spinning its wheels.

The Balance Sheet shows Cash-in-Hand of some $0.5bn. If the share price halves from here, the enterprise will effectively be for sale for less than its cash holdings. Its Net Assets remain positive, therefore theoretically, a rescue operation could (possibly) be successful. Its debt load is three times its net Assets which is not an impossible number. BOOM suspects that the company’s shares are being driven down by an algorithmic trading operation, pending a takeover bid. If not, then Chapter 11 bankruptcy will be inevitable.

BOOM is intrigued by large companies that lose their way. The cause is usually poor leadership, perhaps very poor leadership. Bad luck is not an excuse for these enterprises. They have huge resources and yet their leaders still manage to destroy what was once a thriving entity. It takes a very significant lack of skill to do that.

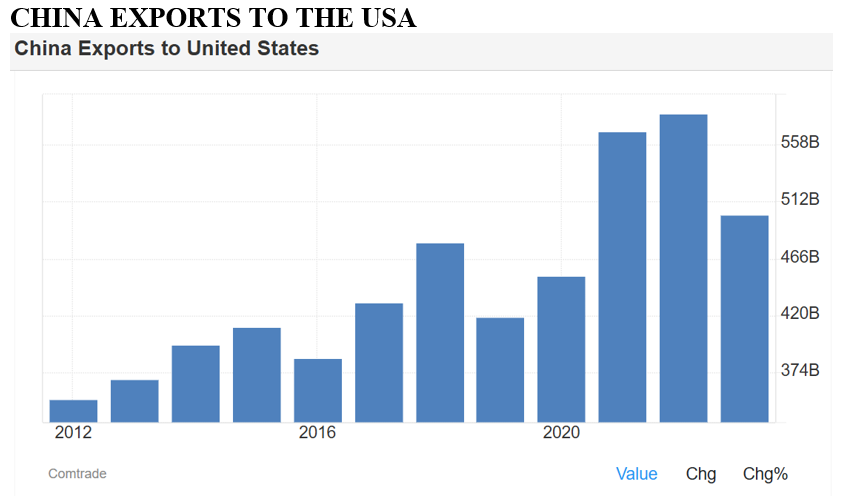

TARIFFS WARS WILL NOT HELP THE USA. There is now a religious belief in Trump followers that a golden age of US economic recovery will be triggered by a Tariff war with its largest trading partners, some of whom have been staunch allies for many years. “America First” is the slogan that Trump uses. That slogan implies that everyone else is last.

BOOM reminds readers that slogans used by politicians are almost always a form of propaganda and are almost always far removed from reality. Trump has also said that, "he has never seen a Tariff he didn’t like”. And, “Tariffs are the greatest thing ever invented”. On another occasion he said, “tariff is the most beautiful word in the English language”.

We shall see, because BOOM recalls the disastrous Tariff war that was invoked during Trump’s first Presidency against China. China definitively won that particular battle. So BOOM cannot understand Trump’s continuing enthusiasm for this economic strategy.

TRUMP REJECTS AUSTRALIA. Trump has recently rejected the Australian government’s pleas to not place tariffs on Australian products being exported to the United States. This will impact sales from Australian manufacturers. Australia will not be granted an exemption which means that 25% tariffs on aluminium and steel imports into the US will apply.

Australian manufacturers will simply switch to other markets. A few phone calls will suffice. However, Australia’s relationship with the US has been badly damaged and Trump cannot fix that as easily as he has damaged it. By the way, Australia’s largest trading partner is not the United States; it is China and by a long margin.

THE TARIFF STRATEGY – HOW TO NOT WIN FRIENDS AND INFLUENCE PEOPLE. Trump has ordered tariffs to be placed on imports from certain countries, as well as imports of certain types of products.

Chinese imports were hit with new 10% tariffs on February 4, which were doubled to 20% a month later.

Tariffs of 25% on Canadian and Mexican imports were put in place on March 4. But Trump later signed an order that exempted imports that were covered by a previous trade deal.

The 25% tariffs on all steel and aluminium imports, including those from Australia, took effect last Wednesday. Trump has threatened to double them to 50% for Canadian steel and aluminium imports as part of the escalating trade war with that country.

BOOM is certain that the Trump policy will damage America’s relationships with many nations and will not help the US economy. This is called a 'lose-lose scenario'. But WHAT A DEAL for Trump, for the people of America, and for those nations and companies that export to the United States.

In an advanced economy such as the USA, tariffs are actually a tax on the middle class. The costs are usually passed to the consumer by the importing company. However, Trump wants to stick to his delusion. Last year, during the election campaign, he said, “It’s not a tax on the middle class. It’s a tax on another country." Perhaps someone should buy Donald a copy of Dale Carnegie’s famous book, “How to Win Friends and Influence People”?

RARE EARTHS ARE NOT RARE; HARSHER FACTS. China is the largest producer of rare earths with 57% of world production in 2020, followed by the USA with 15%. Rare Earths are often called critical materials, or strategic metals, as they are considered to have national interest. Last week, BOOM pointed out that Rare Earth minerals are not rare. Here is a list of Australian Rare Earth companies that are listed on the Australian Stock Market — it is rather long:

Acdc Metals Ltd, Alkane Resources Ltd., Australian Rare EARTHS Ltd., Ardea Resources Ltd, American Rare EARTHS Ltd, Arafura Rare EARTHS Ltd, Askari Metals Ltd, Andean Silver Ltd, Brazilian Rare EARTHS Ltd, Caprice Resources Ltd, Green Critical Minerals Ltd, Hastings Technology Metals Ltd, Havilah Resources Ltd, Iluka Resources Ltd, Iondrive Ltd, Ionic Rare EARTHS Ltd, Krakatoa Resources Ltd, Lynas Rare EARTHS Ltd, Meeka Metals Ltd, New Frontier Minerals Ltd, Osmond Resources Ltd, Peak Rare EARTHS Ltd, RAREX Ltd, Strata Minerals Ltd, VHM Ltd.

VAST RARE EARTHS RESERVES ARE FOUND IN THE USA. Why is Donald Trump interested in Ukraine’s Rare Earth minerals? The US has its own vast Rare Earths reserves and is the second largest global REE producer thanks to its sole operating mine, Mountain Pass. However, it currently lacks sufficiently large processing facilities. These are the two largest American Rare Earth companies:

MP MATERIALS (Stock Code – MP). MP Materials, the largest producer of Rare Earths outside China, focuses on high-purity separated neodymium and praseodymium (NdPr) oxide, heavy Rare Earths concentrate, lanthanum and cerium oxides, and carbonates. The company went public in mid-2020 after acquiring the Mountain Pass mine in California, the only operational US-based Rare Earths mine and processing facility. In April, MP Materials was awarded US$58.5 million to support construction of the first fully integrated Rare Earth magnet manufacturing facility in the US.

ENERGY FUELS (Stock Code UUUU). The company finished construction of Phase 1 REE separation infrastructure at White Mesa in early 2024, and in June reported production of separated Neodymium that meets the specifications required for REE-based alloy manufacturing. Rare Earth elements prices are hard to come by, as there is no widely used public exchange. Spot prices are listed on websites such as Kitco and Metals Prices, however they are infrequently traded and pricing should be approached with caution.

COMING NEXT:

Letter from Great Britain – WARTIME ISSUE - Saturday, March 22, 2025

BOOM Global Financial Review, Tuesday, March 25, 2025

In economics, things work until they don’t. Make your conclusions and do research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — this is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy. Watch the short 15-minute video and see Professor Richard Werner brilliantly explaining how global banking systems work.

In 2014, Richard Werner provided the first empirical evidence that banks create credit out of thin air. They do this whenever they issue a loan or, more specifically, purchase a promissory note. This is a walk-through of exactly how they do it.

Many economists are unaware of this and even ignore the banking & finance sectors in their econometric models. Prof Richard Werner explains how things are going now with CBDCs:

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that website or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities or investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources that are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. By Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

I take solace that after so many "hard-lessons" my funds invested are safe - do you want to know why P&S - and remember - I invested in RSX to learn this final hard lesson maybe - but I still have hope for amends on that - but whatever - my investments are essentially precious metal (backed physically per audits) and the US economy - with interest paid based on current inflationary status.

~

And know this - if the bankers think they gonna steal anymore - like RSX was essentially robbed from my by a bunch of damn crooks - know this - it won't be stood for - it will be WAR!