HISTORIC MEETING OF BRICS NATIONS IN KAZAN, RUSSIA – UN Secretary General Attends – A Brics Clear Depository: Financial System Proposal Announced at Kazan - [10-29-24]

Direct from BOOM Finance and Economics

Hat Tip to my colleague at BOOM Fin4ance and Economics Substack (Subscribe for Free) - also on LinkedIn and WordPress. Covid Medical News Network CMN News BOOM Blog and All Editorials (over 5 years) at BOOM Finance and Economics | Designed for Critical Thinkers — UPDATED WEEKLY (WordPress.com)

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers, and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn.

BOOM EDITORIAL THIS WEEK

HISTORIC MEETING OF BRICS NATIONS IN KAZAN, RUSSIA – The UN Secretary General Attends, the Presidents of Turkey and United Arab Emirates and another 35 National Delegations. The 16th BRICS Summit meeting was held in Kazan, Russia last week, hosted by President Vladimir Putin. The most significant developments were:

Announcement of a new international financial Clearing House which would facilitate the settlement of trade and capital movements in national currencies rather than by using the US Dollar and

support of the BRICS Group for reform of the United Nations Security Council and the Bretton Woods Institutions established in 1945.

An alternative, BRICS based, insurance and re-insurance industry was also proposed.

Russia is clearly not being isolated geopolitically. Broad support for Vladimir Putin and the BRICS Group of Nations concept was clearly on show from the many nations that attended.

The first BRICS formal summit was held on 16th June 2009, 15 years ago.

Kazan is the largest city and capital of Tatarstan, on the magnificent Volga River and has a population of nearly two million residents in the greater metropolitan area. Kazan is the fifth-largest city in Russia, being the most populous city on the Volga. The people of Kazan are 47% Russian and 49% Tatar.

This Summit was the first meeting for the new members of the BRICS Group: Egypt, Ethiopia, Iran and the United Arab Emirates (UAE). They were welcomed by the Founding nations Brazil, Russia, India, China and South Africa. Does that make them the BRICSEEIUAE? BOOM doesn’t think so. It will remain known as the BRICS Group.

Two days before the start of the summit, Lula da Silva, the President of Brazil, announced that he would not be attending in person. He suffered from a minor brain haemorrhage following a fall. However, he announced he would participate via videoconferencing.

Other non-member nations attending were (notably) Saudi-Arabia, Thailand and Vietnam. The Secretary General of the United Nations, Antonio Guterres, also attended. And so did President Recip Erdogan of Turkey and the UAE President, His Highness Sheikh Mohamed bin Zayed Al Nahyan. The attendance of these three leaders is very significant.

The presence of Saudi Arabia, UAE, Turkey, Iran and Egypt represents the major powers of the Middle East excluding and surrounding Israel. Through BRICS, the massive Eurasian landmass which includes Russia, China and India appears to be forming into a giant rival to the US, Western Europe and the UK. The balance of geopolitical, industrial, economic, and financial power is clearly moving East.

Combined, the BRICS members currently encompass about 34% of the world’s land surface and 45% of the global population. South Africa has the largest economy in Africa whereas Brazil, India, and China are among the world’s ten largest countries by population, area, and gross domestic product (GDP).

All five initial member states are members of the G20, with a combined nominal GDP of US$28tn (about 27% of the gross world product). However, expressed in Purchasing Power Parity terms, their total GDP (PPP) is over US$65tn. That is 36.7% of global GDP (PPP), over one third of all the transactions that occur daily on Earth. Industrial production is almost 40% of the Earth’s total.

BRICS is slowly but surely becoming a serious grouping of nations with mutual aspirations of cooperation without domination. They appear determined to create a new world of mutual benefit with ambitions to move beyond the Bretton Woods world created and dominated by the United States since 1944.

This year, on 2nd September 2024, Turkey officially applied to join BRICS. Turkey has been a member of NATO since 1952 and a candidate country for European Union membership since 2005. The EU membership process was frozen on 13th March 2019.

In September 2022, the Turkish President, Recip Erdogan, announced that his country would also apply for membership in the Shanghai Cooperation Organisation. On 11th July 2024, President Erdoğan stated that they did not consider Turkey’s possible membership in the Shanghai Cooperation Organisation and BRICS as an alternative to NATO.

If Turkey and Saudi Arabia were to become full Members of BRICS and the Shanghai Cooperation Organisation, it would herald a new era in the geopolitical balance of power, both militarily and economically. BOOM is expecting that to happen in the not too distant future.

Argentina and Algeria have recently decided not to join the BRICS group. Both nations are relatively inconsequential from a geopolitical viewpoint. They appear to have walked away from a historic opportunity. The following countries have either expressed interest in joining BRICS or have already applied for membership:

Within 48 hours of the Summit meeting close, the following five significant events occurred: The President of Ukraine, Vladimir Zelensky, rejected a visit to his country by Antonio Guterres because the UN secretary-general had attended the BRICS Summit in Russia. This is a slap in the face to the UN and to all other nations who attended. It was ill advised and will not help Ukraine in any way.

On Friday, the Russian president reiterated that Moscow is ready for “rational compromise” on Ukraine but stated, as always, that further peace negotiations must begin with the 15-point agreement almost reached between negotiators from Ukraine and Russia in Turkey in 2022. That agreement was famously abandoned by Ukraine after Boris Johnson visited Zelensky in April 2022 and strongly encouraged war rather than peace.

The Serbian Deputy Prime Minister said “Trying to isolate Russia is “stupid” and impossible because the country represents a set of values that are in great demand in the modern world. He stated the values of “God, nation, family”. Serbia sent a delegation to the summit in Kazan. They explained that “because BRICS is changing the world… and Serbia wants to be part of that new world. The death of unilateralism has already happened, and Serbia wants to be part of any kind of hope that BRICS has offered to humanity.”

The President of Hungary, Victor Orban made these statements –– “The Westerners do not want to end the Russia-Ukraine war, but apparently want it to continue, want to go to war, now they also want to go to war in the economy”. And –– “They are up to their necks in this pickle, they are in a losing war, they are losing a war right now.”

Orban went on to say that the West has fallen prey to “Cold War logic” when it comes to the Ukraine conflict, reverting to the old modes of thinking and choosing to wage war not just in the security sphere, but in the economic one as well, with sanctions not just for Russia but also China.

The President of the European Council, Charles Michel, said that the EU must stop lecturing the world. “The European Union needs to stop “lecturing” other parts of the world and be more respectful towards its partners in order to combat the growing influence of Russia and China. In an interview with the Financial Times published on Friday, Michel said that the EU has become “convinced that we know what is right and what is wrong” and often fails to make an effort to understand why other countries may think otherwise.

HYPOCRISY OF THE WEST — THE MEMORY OF IRAQ AND AFGHANISTAN

Charles Michel, Victor Orban and Antonio Guterres seem acutely aware of the growing hypocrisy of the West. Many EU nations plus the US and the UK have been sending $Billions of weapons and money to both the Ukraine war, and to the war being waged by Israel in the Middle East, while demanding peace from Russia in the Ukraine.

The memory of the US-led invasion of Iraq in 2003 lingers in the minds of many diplomats when the promised “weapons of mass destruction” were not found after being the rationale for the aggressive military occupation. It is estimated that up to 655,000 Iraqi citizens died violent deaths in that fiasco which has become a major stain on the history of the United States and the so-called “Coalition of the Willing”.

Of the 48 countries on the list of “the Willing”, four contributed troops to the invasion force (the United States, the United Kingdom, Australia and Poland). An additional 37 countries provided some number of troops to support military operations after the invasion was complete. The more recent fiasco of US withdrawal from Afghanistan after 20 years of military occupation is also fresh in the minds of diplomats.

THE KAZAN JOINT DECLARATION

Below are the key points from the Kazan declaration issued by the BRICS group after the summit with BOOM’s comments appearing in the headlines.

ON UKRAINE: — The BRICS Group emphasised the centrality of the UN Charter 1945. “We emphasize that all states should act consistently with the Purposes and Principles of the UN Charter in their entirety and interrelation. We note with appreciation relevant proposals of mediation and good offices, aimed at a peaceful resolution of the conflict through dialogue and diplomacy.”

The Preamble to the UN Charter 1945 reads — “WE THE PEOPLES OF THE UNITED NATIONS DETERMINED to save succeeding generations from the scourge of war, which twice in our lifetime has brought untold sorrow to mankind, and to reaffirm faith in fundamental human rights, in the dignity and worth of the human person, in the equal rights of men and women and of nations large and small, and to establish conditions under which justice and respect for the obligations arising from treaties and other sources of international law can be maintained, and to promote social progress and better standards of life in larger freedom,

AND FOR THESE ENDS to practice tolerance and live together in peace with one another as good neighbours, and to unite our strength to maintain international peace and security, and to ensure, by the acceptance of principles and the institution of methods, that armed force shall not be used, save in the common interest, and to employ international machinery for the promotion of the economic and social advancement of all peoples”

ON THE MIDDLE EAST: — The Group expressed grave concern and called for immediate cessation of military acts. “We reiterate our grave concern at the deterioration of the situation and humanitarian crisis in the Occupied Palestinian Territory, in particular the unprecedented escalation of violence in the Gaza Strip and in the West Bank as a result of the Israeli military offensive, which led to mass killing and injury of civilians, forced displacement and widespread destruction of civilian infrastructure.”

“We express alarm over the situation in Southern Lebanon. We condemn the loss of civilian lives and the immense damage to civilian infrastructure resulting from attacks by Israel in residential areas in Lebanon and call for immediate cessation of military acts.”

ON WESTERN SANCTIONS: The Group is not happy with unlawful, unilateral coercion and sanctions being applied by the US and its allies. “We are deeply concerned about the disruptive effect of unlawful unilateral coercive measures, including illegal sanctions, on the world economy, international trade, and the achievement of the sustainable development goals.”

ON THE INTERNATIONAL FINANCIAL SYSTEM’S REFORM: The Group seeks reform of the global financial system away from US dominance. “We underscore the need to reform the current international financial architecture to meet the global financial challenges including global economic governance to make the international financial architecture more inclusive and just.”

ON REFORM OF THE UNITED NATIONS: The Group is in favour of reforming the Security Council, giving more power to the BRICS Group and especially African nations. “Recognizing the 2023 Johannesburg II Declaration we reaffirm our support for a comprehensive reform of the United Nations, including its Security Council, with a view to making it more democratic, representative, effective and efficient, and to increase the representation of developing countries in the Council’s memberships so that it can adequately respond to prevailing global challenges and support the legitimate aspirations of emerging and developing countries from Africa, Asia and Latin America, including BRICS countries, to play a greater role in international affairs, in particular, in the United Nations, including its Security Council. We recognise the legitimate aspirations of African countries, reflected in the Ezulwini Consensus and Sirte Declaration”

ON BRICS GRAIN EXCHANGE: The importance of food supply, especially grain is emphasised. “We welcome the initiative of the Russian side to establish a grain (commodities) trading platform within BRICS (the BRICS Grain Exchange) and to subsequently develop it including expanding it to other agricultural sectors.”

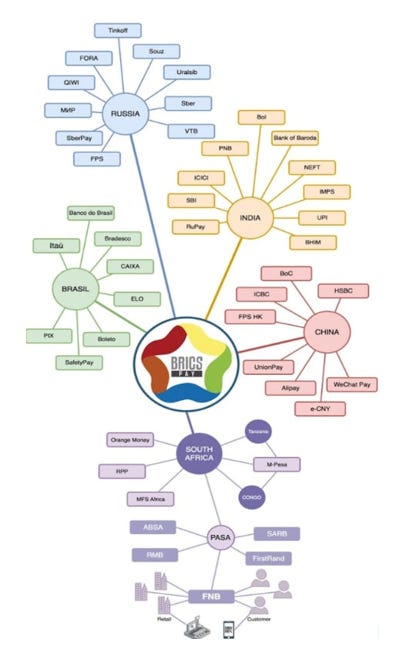

ON BRICS CROSS-BORDER PAYMENT SYSTEM: They wish to set up an alternative to the US dominated SWIFT — BRICS BRIDGE, BRICS PAY and the BRICS CLEAR (Clearing House). “We recognise the widespread benefits of faster, low cost, more efficient, transparent, safe and inclusive cross-border payment instruments built upon the principle of minimizing trade barriers and non-discriminatory access. We welcome the use of local currencies in financial transactions between BRICS countries and their trading partners.”

ON BRICS CLEAR DEPOSITORY: Perhaps the most significant new financial system proposal announced at Kazan; The BRICS Group of nations wants to establish an independent payment system based on their national currencies including a financial Clearing House.

“We agree to discuss and study the feasibility of establishment of an independent cross-border settlement and depository infrastructure, ‘BRICS Clear’, an initiative to complement the existing financial market infrastructure, as well as BRICS independent reinsurance capacity, including BRICS (Re)Insurance Company, with participation on a voluntary basis.”

To understand why the word “Clear” is being used here, readers should understand what a Financial Clearing House is and why as it is the key to effecting a viable alternative to SWIFT. This is a huge undertaking which will take many years to establish. Here is an excellent explanation from Wall Street Oasis:

A clearing house’s primary responsibility is to ensure the transaction goes off without a hitch, with the seller receiving the correct amount for the tradable items they are selling and the buyer obtaining the goods they intended to buy. Any two businesses or parties involved in a financial transaction can use a clearing house as a mediator.

In a financial market, a clearing house is an authorized middleman between a buyer and a seller. By validating and completing the transaction, it makes sure that both the buyer and the seller adhere to their contractual commitments. Every financial market has an internal clearing section or a recognized clearing house to execute this task. Its duties include “clearing” or concluding trades, settling trading accounts, gathering margin payments, controlling asset delivery to new owners, and disclosing trading information.

When it comes to futures and options transactions, these serve as both buyers and sellers, acting as buyers for every clearing member seller and sellers for every clearing member buyer. Key Takeaways

Clearing houses act as intermediaries between buyers and sellers in financial transactions, ensuring smooth and secure trade execution.

Clearing houses clear trades, settle accounts, collect margin payments, facilitate asset delivery, and provide trading information.

Clearing houses impose margin requirements to ensure traders have adequate funds to cover potential losses, reducing the risk of default.

Clearing houses play a crucial role in futures markets by managing leverage and ensuring traders meet margin requirements.

ON FINANCIAL INNOVATION: The Group needs more cooperation and communication between its various central banks and their client commercial and retail banks. “We welcome the BRICS Interbank Cooperation Mechanism (ICM) focus on facilitating and expanding innovative financial practices and approaches for projects and programmes, including finding acceptable mechanisms of financing in local currencies.”

ON THE IMF: The Group wants to maintain the IMF but seeks reform of all the institutions established at Bretton Woods in 1944 (including the IMF). “We reaffirm our commitment to maintaining a strong and effective Global Financial Safety Net with a quota-based and adequately resourced IMF at its centre.” “We call for the reform of the Bretton Woods institutions”.

ON G20: The Group wants to maintain ties to the G20 Nations — presumably until BRICS grows to become economically larger than the G20. “We underscore the key role of the G20 as the premier global forum for multilateral economic and financial cooperation that provides a platform for dialogue of both developed and emerging economies on an equal and mutually beneficial footing for jointly seeking shared solutions to global challenges. We recognise the importance of the continued and productive functioning of the G20, based on consensus with a focus on result-oriented outcomes.”

ON THE UN SUSTAINABLE DEVELOPMENT GOALS: These are “stressed” but not committed to. “We stress the universal and inclusive nature of the 2030 Agenda for Sustainable Development and its Sustainable Development Goals …”

ON CLIMATE CHANGE: The Group “reiterates” and seeks reform but does not make further commitments. “We reiterate that the objectives, principles and provisions of the United Nations Framework Convention on Climate Change (UNFCCC) …”

ON PREVENTION OF FUTURE PANDEMICS: The Group clearly wants to move away from the WHO dominance in global health matters. They “reiterate” again …. without further commitments. They support the BRICS R&D Vaccine Centre. “We support the initiatives of the BRICS R&D Vaccine Centre, further development of the BRICS Integrated Early Warning System for preventing mass infectious diseases risks.” “We reiterate our support to the central coordinating role of the World Health Organization in the implementation of multilateral international efforts to protect public health from infectious diseases and epidemics and commit to reform and strengthen the international pandemic prevention, preparedness and response system”

The Full Kazan Declaration is available HERE (134 Paragraphs). There is a great deal to consider, especially in regard to reform of many global institutions established at Bretton Woods in 1944. BOOM suggests that readers look closely at the choice of words used in the document.

PUTIN’S KEY SPEECH. [Please note that BOOM has not yet seen an official copy of the Speech transcript and is thus reliant upon media commentary.] In his speech, Putin (reportedly) focused on the growing role and prospects of the economic group, and warned about the risks to the global economy from Western sanctions and protectionist policies.

He also announced Russia’s initiatives within the BRICS framework, including the formation of a grain exchange, boosting the role of the New Development Bank (based in Shanghai), and a new international financial system including a BRICS Clearing House which would facilitate the settlement of trade and capital movements in national currencies rather than using the US Dollar. Here are the key takeaways from the Russian president’s address.

Multipolar world order is being formed. World trade and the global economy as a whole are undergoing significant changes, the Russian president told the BRICS meeting. The centre of business activity is gradually shifting towards developing markets. “A multipolar model is being formed, which is launching a new wave of growth, primarily due to the countries of the Global South and East – and, naturally, the BRICS countries.”

The Russian President said that the BRICS economies have been demonstrating “sufficient stability” due to responsible macroeconomic and fiscal government policies, noting accelerated growth rates are expected in the medium term. Putin cited preliminary estimates that average BRICS country economic growth in 2024-25 will be 3.8%, compared to global figure of 3.2-3.3%.

The BRICS countries’ share of global GDP in terms of purchasing power parity (PPP) will amount to 36.7% by the end of 2024 and will continue to expand, Putin predicted. Meanwhile, the share of the Group of Seven (G7) leading Western economies is projected to account for slightly above 30%.

“The trend for the BRICS’ leading role in the global economy will only strengthen,” Putin said, citing population growth, capital accumulation, urbanization, and increased labor productivity, accompanied by technological innovations as key factors.

The West’s unilateral sanctions and debt burden. The Russian president warned of a potential new global crisis, citing the growing debt burden in developed countries, unilateral sanctions, and protectionist policies as key threats. “These factors are fragmenting international trade and foreign investment, particularly in developing nations.”

He also pointed to high commodity price volatility and rising inflation, which are eroding incomes and corporate profits in many countries. Putin’s remarks also highlighted concerns over escalating geopolitical tensions and their impact on global economic stability.

New BRICS investment platform as a powerful tool. The Russian leader said that to fully realize the potential of the BRICS countries’ growing economies, the member states should intensify cooperation in areas such as technology, education, resources, trade and logistics, finance, and insurance, as well as increasing the volume of capital investment many times over.

“In this regard, we propose creating a new BRICS investment platform, which would become a powerful tool for supporting our national economies and would also provide financial resources to the countries of the Global South and East,” Putin said.

BRICS-based grain exchange. The Russian leader proposed a common BRICS grain exchange to protect trade between members from excessive price volatility. BRICS countries are “among the world’s largest producers of grain, vegetables, and oilseeds,” he noted. Such a bourse could be expanded to trade in other major commodities such as oil, gas and precious metals, Putin said.

The initiative is aimed at protecting national markets from negative external interference, speculation and attempts to cause artificial shortages of food products, according to Putin.

AI Alliance of BRICS. Putin also proposed a BRICS AI alliance to regulate the technology and prevent its illegal deployment. “In Russia, the business community has adopted a code of ethics in this area, which our BRICS partners and other countries could join,” Putin noted.

Other proposals. The president also spoke about increasing transport connectivity between BRICS countries, saying this could provide additional opportunities for growth and diversification of mutual trade. “Such promising projects as the formation of a permanent BRICS logistics platform, preparation of a review of transport routes, opening of an electronic communications platform for transport, and establishment of a reinsurance pool are being discussed,” Putin said.

XI JINPING’S KEY SPEECH

In his speech at the summit on Wednesday, Chinese President Xi Jinping said “the reform of the international financial architecture” is “pressing,” and he called for “the connectivity” of financial infrastructure among BRICS members and the expansion of the New Development Bank, or NDB.

Headquartered in Shanghai, the NDB was established by the initial five BRICS members in 2015. It serves as a possible alternative financial institution to the World Bank and the International Monetary Fund but it is not a large institution at present. BOOM’s Comment:

An alternative payment system such as is proposed by BRICS, aims to reduce excessive reliance on the US Dollar. The US Dollar dominates in trade and capital settlements because of its convenience, stability, liquidity and convertibility. It is a volume game – pure and simple — the Eurodollar Volume Game. Eurodollars are offshore US Dollars, outside the control of the US Treasury and Federal Reserve. They reside on bank ledgers all over the world.

BOOM has explained that many times in previous editorials. How to replace the huge volume and convenience of Eurodollar dominance is the most difficult challenge for the BRICS aligned group of nations moving forward. As far as BOOM can see this will take many years. In fact, it will possibly take many decades.

To do that, they will initially need to create sufficient foreign national currency volumes to be held by all of the BRICS central banks to make settlements easy to complete within their group. This is not as easy as it sounds, especially as the Group threatens to expand rapidly.

By contrast, the Eurodollar system has evolved since the 1960’s. Eurodollar volumes have been created in response to demand. They have been formed as bank loans denominated in US Dollars held on the ledgers of global, international banks and UK regulated tax haven banks. That evolution has occurred over six decades.

Some commentators are suggesting that a BRICS “Stablecoin” could be created based upon a basket of BRICS national currencies and held on a joint access Blockchain Ledger. However, such a Stablecoin would be in the form of a digital token and thus they would be pure fiat by its very nature. It would not reflect any real world collateral assets. And it would not be created from demand. Supply would have to precede demand. That is a back-to-front world in finance and may boost global inflationary pressures. Such a centralized BRICS Stablecoin would also need an oversight committee (of clever economists?) to decide the weightings of each currency.

Some have suggested a Gold-backed Stablecoin system (or a mix of fiat and gold) but this creates the age-old problem of finding sufficient gold going forward and pricing it correctly. In other words, if the price of gold was to remain stable, more gold would have to be found, mined and refined to expand the money supply of Stablecoin tokens. Alternatively, the price of gold would have to rise to expand the total value of the money supply.

As BOOM always says, pricing gold in regard to currencies always requires a committee of very clever economists and BOOM cannot identify many clever economists, let alone a committee of them. The current “market” price for gold is dominated by the US Dollar value. So that cannot be a way forward for any new gold-backed system which is aimed at supplanting US Dollar dominance.

BRICS PAY — THE PUSH FOR DE-DOLLARIZATION. A major Russian theme of the summit was the push for de-dollarization, the move away from using the US Dollar as an intermediary currency in global trade and capital settlements. This move has been accelerated by recent US sanctions on Russia and freezing access to $300bn of Russian deposits held in Brussels. The US and UK are now proposing to hand over the investment returns from that Russian capital to Ukraine (which amounts to outright piracy and theft).

The BRICS group has worked on a new payment card named BRICS Pay which is designed to facilitate the interchange of financial information between the central banks of the BRICS allied nations, serving as an alternative to the US dominated, Western inter-bank messaging system SWIFT, based in Brussells.

This makes BRICS Pay an alternative to SWIFT in many ways. Central banks would be able to use both (hopefully) in the long run, depending upon preference between the nations participating in each transaction.

Progress has been slow. The BRICS nations have been discussing the establishment of an alternative payment system to SWIFT since 2005. China has launched its alternative to SWIFT called CIPS (the Cross-Border Interbank Payment System). India also has its alternative system called SFMS (the Structured Financial Messaging System. Russia has established the SPFS, System for Transfer of Financial Messages (SPFS)and Brazil has its own Brazilian instant payment (IP) ecosystem – the PIX.

THE BRICS BRIDGE – A HIGH SPEED DIGITAL FUTURE? Russia has proposed to BRICS countries and partnership members a mechanism for cross-border payments based on the BRICS Bridge settlement platform. The mechanism would see BRICS members’ central banks issue Digital Financial Assets (DFAs), presumably non-fungible tokens (NFTs) which would in turn peg their value to the national currencies of the participating countries.

The digitisation of Financial assets is relatively straightforward. Assets (especially financial assets) can be digitally tokenized using national electronic ledgers which can assure proof of ownership and provenance. These systems already exist in most nations. However, that is not enough as a trusted global BRICS Clearing House would be essential for the safe transfer of assets from buyer to seller.

The current vision for such a global system seems to imply that all of these functions will be the responsibility of each nation’s central bank. That may not be acceptable to many nations where financial asset registers may be managed by independent State owned (or private) non-bank financial institutions under State regulation and where the funds transfers are done on an inter-bank basis. There are also significant legal impediments to such a vision of the future.

For the system to fully effect instant payment/settlement and instant transfer of ownership, there needs to be a great deal of inter-national cooperation between all of those institutions. Trust is the essential element of all asset transfers to ensure legal ownership, provenance and settlement. Inside nations, the commercial banking systems perform many of these tasks on a day to day basis. However, instant payment and transfer is not the norm in most nations. And certainly not the norm in international transactions.

THE M-BRIDGE PAYMENT PLATFORM FOR CENTRAL BANKS. mBridge (the multiple CBDC Bridge) is a payment platform developed to support real-time, peer-to-peer, cross-border payments and foreign exchange transactions using Central Bank Digital Currencies (CBDC’s) also known as electronic cash). Based on an immutable blockchain ledger called the mBridge Ledger, the platform is designed to ensure compliance with jurisdiction-specific policy and legal requirements, regulations, and governance needs.

This proposal has a major problem and that is in regard to the concept of CBDC’s – electronic cash – which is failing in all of its iterations globally due to central banking constraints and lack of enthusiasm from the public.

Currently five entities are jointly developing the so-called mBridge. They include the Hong Kong Monetary Authority (HKMA), the Bank of Thailand (BoT), the Central Bank of the United Arab Emirates (CBUAE), the Digital Currency Research Institute of the People’s Bank of China (PBC DCI), and the BIS Innovation Hub Hong Kong Centre (BISIH Hong Kong Centre). Saudi Arabia’s central bank joined recently, in June 2024. However, mBridge is not the only platform under development using proposed CBDC’s, there are also other ongoing projects aiming to improve cross-border transactions with CBDCs. Here are some of them.

In BOOM’s opinion, all of these projects will fail as the CBDC concept fails.

Project Aurum. A full-stack (front-end and back-end) CBDC system comprising a wholesale interbank system and a retail e-wallet system, bringing to life intermediated CBDC and stablecoins backed by CBDC in the interbank system. Collaborators: BIS, Hong Kong Monetary Authority, Hong Kong Applied Science and Technology Research Institute

Dunbar. On 22 March 2022, the BIS Innovation Hub, the Reserve Bank of Australia, Bank Negara Malaysia, the Monetary Authority of Singapore, and the South African Reserve Bank announced the completion of prototypes for a shared Dunbar platform, enabling international settlements using multiple CBDCs.

Cedar x Ubin+. The Cedar x Ubin+ project, the flagship venture of the New York Innovation Center (NYIC) in collaboration with the Monetary Authority of Singapore, is a multi-phase technical research initiative that evaluates the potential applications of wholesale CBDCs, built with distributed ledger technology to enhance the efficiency and transparency of cross-border payments.

Mariana. In October 2023, the Bank for International Settlements, in partnership with the central banks of France, Singapore, and Switzerland, confirmed the successful completion of the Mariana project, which explored cross-border trading and settlement of wholesale CBDCs among financial institutions while integrating decentralized finance technology on a public blockchain.

Icebreaker. In March 2023, the Bank for International Settlements, in collaboration with the central banks of Israel, Norway, and Sweden, completed the Icebreaker project, which examined the technical feasibility of using retail CBDCs in international payments.

Jura. In November 2021, the consortium responsible for Jura project, comprising the Bank for International Settlements, Banque de France, Swiss National Bank, and various private firms, explored the direct transfer of Euro and Swiss franc wholesale CBDCs between French and Swiss commercial banks on a single distributed ledger platform. The group officially confirmed the experiment’s success in a report released on December 8, 2021.

To read why the CBDC concept is doomed to failure, please read BOOM’s recent analysis on the matter. What is good about Physical Cash? And ….. What is bad about CBDC’s? September 29 Edition.

COMING NEXT:

Letter from Great Britain – Decrepit Britain – Saturday, November 2, 2024

BOOM Global Financial Review, Tuesday November 5, 2024

In economics, things work until they don’t. Make your conclusions and do research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — this is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy. Watch the short 15-minute video and see Professor Richard Werner brilliantly explaining how global banking systems work.

In 2014, Richard Werner provided the first empirical evidence that banks create credit out of thin air. They do this whenever they issue a loan or, more specifically, purchase a promissory note. This is a walk-through of exactly how they do it.

Many economists are unaware of this and even ignore the banking & finance sectors in their econometric models. Prof Richard Werner explains how things are going now with CBDCs:

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that website or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities or investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources that are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. By Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.